Budget 2013 – Initial Impressions of SR&ED Changes

Reference Article (>5 Years Old)

Budget 2013 – How was SR&ED Affected?

The Budget 2013 saw a number of small changes to the SR&ED program though nothing groundbreaking in terms of eligibility, but interesting outreach and additional requirements for consultants. We haven’t had a chance to fully digest the budget yet (check back soon!), but in the meantime here are a few interesting quotes for your perusal.

Key Quotes on SR&ED

Canada Revenue Agency Delivers on the Needs of Small Businesses

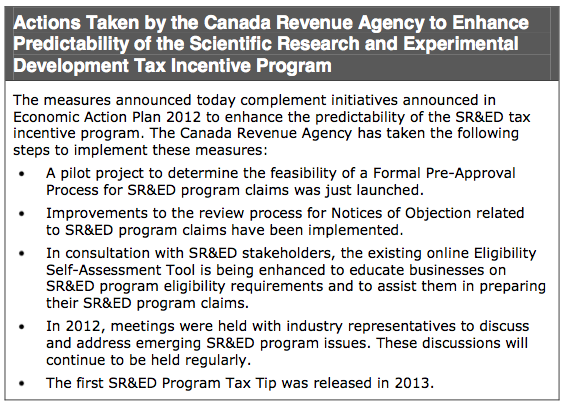

The CRA is undertaking several initiatives to reduce the tax compliance burden associated with the Scientific Research and Experimental Development (SR&ED) tax incentive program. In particular, a pilot project to determine the feasibility of a Formal Pre-Approval Process for SR&ED claims was just launched. This pilot project will provide valuable information on whether a Formal Pre-Approval Process service would be an effective way to provide greater certainty to claimants on the eligibility of their research and development expenditures for SR&ED tax incentives. (P. 126)

Strengthening the Impact of the Scientific Research and Experimental Development Tax Incentive Program

The Scientific Research and Experimental Development (SR&ED) tax incentive program is one of the most generous systems in the industrialized world for research and development (R&D). It is the single largest federal program supporting business R&D in Canada, providing more than

$3.6 billion in tax assistance in 2012.In Economic Action Plan 2012, the Government noted its concern that high contingency fees charged by SR&ED tax preparers reduce the effectiveness of the SR&ED tax incentive program. The Government announced that it would consult on contingency fees charged by SR&ED tax preparers to find out whether these fees diminish the benefits of the SR&ED program to Canadian businesses and the economy. To that end, a discussion paper was released inviting submissions, and consultations were undertaken in 2012.

The submissions received by the Government during the consultations indicated that intervention to regulate contingency fees directly is not required: the market for SR&ED tax preparers is competitive, contingency fee rates have declined over time and there is no evidence that this type of billing arrangement results in higher compliance costs for businesses.

Instead, many stakeholders recommended that the Government enhance the predictability of the SR&ED tax incentive program, and take action to address aggressive positions being taken by some tax preparers and claimants. In line with that feedback, Economic Action Plan 2013 proposes a number of measures:

- New funding of $5 million over two years will be provided to the Canada Revenue Agency to conduct more direct outreach with first-time SR&ED program claimants. A new in-person service will be implemented to ensure that new claimants have access to information about the SR&ED program’s eligibility requirements, the required supporting documentation, and any other information needed to facilitate the filing of their SR&ED program claim. This new in-person service will help new claimants to better understand the SR&ED program parameters, and contribute to reducing taxpayers’ reliance on third-party tax preparers. The Canada Revenue Agency will also develop new web-based seminars that will be available to the SR&ED community at no cost.

- The Canada Revenue Agency will also receive new funding of $15 million over two years to focus more resources on reviews of SR&ED program claims where the risk of non-compliance is perceived to be high and eligibility for the SR&ED program unlikely. The Canada Revenue Agency will also more frequently apply penalties for false statements or omissions, where appropriate. In addition, in order to enable better risk assessment, SR&ED program claim forms will be revised to require more detailed information. To enforce this new requirement, Economic Action Plan 2013 proposes that a new penalty be applied in instances where the new required information is missing, incomplete or inaccurate.

These new initiatives will help protect the integrity of the SR&ED tax incentive program. (P.201-203)

Initial Impressions

Not a lot of changes, though it’s interesting that they’ll be pursuing penalties for non-compliance/omission/inaccuracy (see our other Budget 2013 post on this section of the budget). We’ll be interested to see what revisions they’ll be making to the T661 (and other forms) to ask for the new information. Check back soon for new information!

The 2012 Budget

Links to the budget can be found here: Budget Homepage and SR&ED Section.