CRA Releases SR&ED Self-Assessment and Learning Tool

Reference Article (>5 Years Old)Please note that the information herein may be outdated, links could be inactive, and policies discussed may have evolved. For the most current data, consult our latest publications. If you would like us to refresh this article as it is of interest to you, please contact us. |

Recently, the Canada Revenue Agency (CRA) announced the release of some new services. One of these was the SR&ED Self-Assessment and Learning Tool (SALT), which is meant to “further improve the predictability of receiving the SR&ED tax incentives through a self-assessment of your work and expenditures.” Does it accomplish what it sets out to do? We’ve examined the tool and provided some feedback.

SALT Step 1 – Determine if there is SR&ED

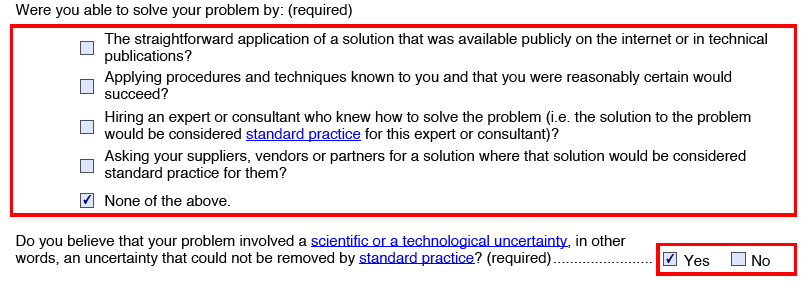

The SALT comes in two steps, the first of which is meant to help predetermine if SR&ED exists before spending time calculating a refund. The introduction explains this is “mainly dedicated to users with a relatively limited knowledge of the SR&ED program.” Step 1 is split out into five parts, each aligned with one of The Five Questions. “Yes or No” questions are asked to determine if the requirements for each of the five eligibility criteria are met. Additionally, there are text areas available to fill in project information for your internal records.

When all questions have been answered, a report is generated indicating whether or not SR&ED has occurred and if you should continue on to Step 2.

Self-Assessment and Learning Tool Step 2 – Determine the extent of work and estimate ITCs

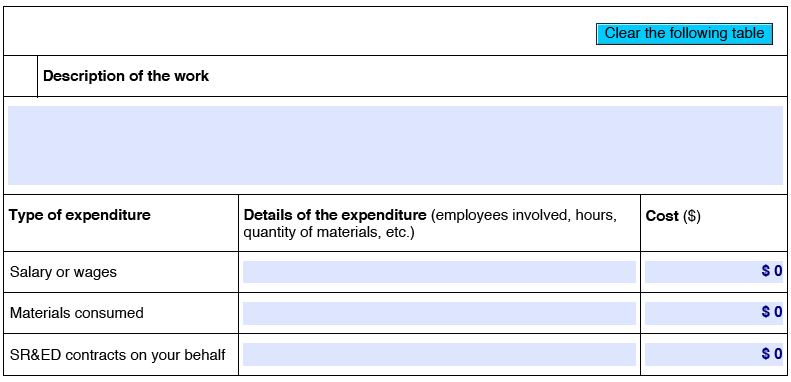

Step 2 of the SALT is meant to “identify the work performed during your project that may be eligible” and “identify or estimate the expenditures associated with each element of eligible work.” It’s only meant to examine one project, so if you have multiple SR&ED projects you’ll need to fill in this form multiple times. After having you give preliminary information regarding your company (e.g., fiscal year start and end dates, CCPC status, etc.), detailed explanations are provided that define eligible SR&ED costs. Using this information, the form asks you to provide estimated eligible expenditures. This is split out into three sections: Initial stage of the SR&ED project, Main Stage of the SR&ED project, and Final Stage of the SR&ED project.

Once all information has been provided, a report is generated indicating the estimated ITCs. This is calculated using the proxy method.

Final Thoughts

The SALT is an excellent tool for companies that are new to SR&ED and want a preliminary estimate of what they could gain from using the program. The guidance provided is thorough and will provide a solid introduction to anyone who doesn’t have much experience with SR&ED. It’s important to note that the estimates provided are indeed estimates—it’s critical that these numbers aren’t taken at face value. Treat the approximation provided as preliminary, then use other resources available to you or experts for assurance.

The CRA also took measures to improve SR&ED preparer confidentiality and announced the First-Time Claimant Advisory Service. Join our LinkedIn group to be instantly updated when we cover these topics.