A Closer Look at Refundable and Non-refundable SR&ED Tax Credits

The terminology utilized within the Scientific Research and Experimental Development (SR&ED) program can often be confusing. We have been asked to clarify, “what the difference is between refundable and non-refundable investment tax credits (ITCs)?” Claimants understandably want to know how they will receive their SR&ED ITCs. This article examines the difference between the two forms of SR&ED ITCs, refundable and non-refundable, and when they may be received.

Refundable and Non-Refundable SR&ED Tax Credits

The Terminology

A refund as defined in the Merriam-Webster dictionary means “to give back or return in restitution, repayment, or balancing of accounts” and the term nonrefundable means exactly the opposite: “not subject to refunding or being refunded”.1 With these definitions in mind, one would assume that a non-refundable tax credit is a bit of an oxymoron. How can it be non-refundable but also a credit?

The Terminology Within the SR&ED Program

To understand what a non-refundable ITC is in comparison to a refundable ITC within the SR&ED program you must first know what Part 1 Tax is. As stated within the Income Tax Act of Canada, every Canadian resident, and resident corporation, must pay income tax on their taxable income for each tax year.2 This is referred to as Part 1 Tax and is calculated on a corporation’s T2 tax forms for the tax year. “All corporations — including non-profit organizations, tax-exempt corporations, and inactive corporations — have to file a T2 return for every tax year, even if there is no tax payable.”3

The T4012 – T2 Corporation – Income Tax Guide states:

The basic rate of Part I tax is 38% of taxable income. To determine the base amount of Part I tax, calculate 38% of the taxable income from line 360 of page 3.4

Part 1 Tax may be paid back by utilizing a claimant’s SR&ED ITCs (offset). Both refundable and non-refundable ITCs may be applied to the Part 1 Tax, however, a refundable ITC may be reimbursed beyond the payment (offset) of the claimants Part 1 Tax. The CRA has defined a refundable ITC within the SR&ED program in the SR&ED Investment Tax Credit Policy:

The investment tax credit (ITC) of certain claimants (see section 4.1) that is not applied in the year to Part I tax, or carried back to a previous year and applied to Part I tax in the previous year, may be refundable. In this context, the term refundable goes beyond a reimbursement of Part I tax already paid and refers to the credit that is reimbursed to the claimant.5

If the claimant’s Part 1 Tax, the taxes they owe for the year, are reduced to nil, they may be eligible to receive their remaining refundable SR&ED ITC directly to them in cash form.

Non-Refundable ITCs, which the CRA also refers to as ‘not refundable’, are not specifically explained within the SR&ED Investment Tax Credit Policy, however, on the CRA’s How your business can benefit from the SR&ED tax incentives page they have stated: “You can use the ITC to reduce tax payable.”6 Any non-refundable credits a claimant receives are used towards their Part 1 Tax for the year. If their Part 1 Tax is reduced to nil, and there are remaining unused ITCs, they may choose to carry them back 3 years or forward 20 years and apply them against any tax payable for other years7.

Eligibility Rules for Refundable SR&ED Tax Credits

Federal SR&ED Tax Credits

The SR&ED Investment Tax Credit Policy states that according to the definition of a refundable ITC in the Income Tax Act and other supporting provisions, only the following types of claimants may earn a refundable ITC:

1) For a CCPC that is a qualifying corporation (see section 4.2), other than an excluded corporation (see section 4.3), the refundable ITC is:

- 100% of the unclaimed balance of the ITC earned in the year at the enhanced ITC rate of 35% for its qualified SR&ED expenditures of a current nature and its prescribed proxy amount (PPA),

- 40% of the unclaimed balance of the ITC earned in the year at the basic ITC rate of 15%, for its qualified SR&ED expenditures (see section 2.2.1).

2) For a CCPC, other than one that is a qualifying corporation or an excluded corporation, the refundable ITC is:

- 100% of the unclaimed balance of the ITC earned in the year at the enhanced ITC rate of 35% for qualified SR&ED expenditures of a current nature and its PPA

An ITC earned at the basic ITC rate by a CCPC, that is not a qualifying corporation or an excluded corporation, is not refundable.

3) For a CCPC that is a qualifying corporation, but is also an excluded corporation, the refundable ITC is 40% of the unclaimed balance of the ITC earned in the current year for qualified SR&ED expenditures.

4) Generally, for an individual (other than a trust), the refundable ITC is 40% of the unclaimed balance of ITC earned in the current year for qualified SR&ED expenditures.

5) Generally for a trust, each beneficiary of which is either a qualifying corporation or an individual (other than a trust), the refundable ITC is 40% of the unclaimed balance of ITC earned in the current year for qualified SR&ED expenditures.8

In Maximum SR&ED refund: Federal level we have included a detailed example of how SR&ED ITCs are calculated for a Canadian-controlled private corporation (CCPC) that is a qualifying corporation. Corporations of this type can receive refundable SR&ED ITCs under regular circumstances, however, if the corporation is not a qualifying corporation, the refund available to them is drastically reduced.

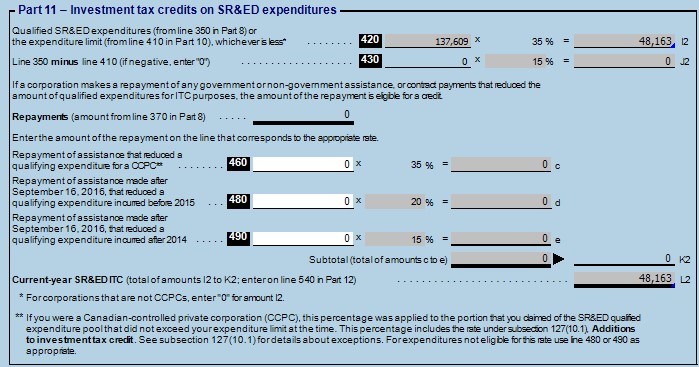

The examples below involve an Ontario-based corporation claiming $100,000 of qualified SR&ED expenditures and the use of the proxy method:

Keep in mind the below is calculated after the PPA has been added, and after accounting for the provincial ITCs:

- $100,000 + PPA of 55% ($55,000)

- =$155,000

- $155,000 – the Provincial ITCs ($17,391)

- =$137,609

Example 1: Qualified CCPC

The above example is a CCPC which is a qualified corporation. In this example, the company’s ITCs are calculated as 35% of the total eligible SR&ED expenditures:

- 35% of $137,609 = $48,163

- The total amount of $48,163 will be available as refundable ITCs and given in cash form to the claimant. Alternatively, the claimant may choose to use all or a portion of the ITCs to offset their Part 1 Tax for the year. The remaining balance is refunded9.

Example 2: Non-CCPC

In this example, the corporation is not a qualified corporation (non-CCPC) and is not eligible for the enhanced ITC rate of 35%. The total expenditures included in their return, $137,609 (including qualified expenditures and overhead as calculated with the proxy method), are calculated at the basic ITC rate of 15%, the entirety of which is non-refundable:

- 15% of $137,609 = $20,641

- A total amount of $20,641 will be available to the claimant as non-refundable ITCs and may be used to offset their Part 1 Tax for the year.

- If their Part 1 Tax for the year is reduced to nil, and there are remaining unused ITCs, they may choose to carry them back 3 years or forward 20 years and apply them against any tax payable for other years10.

Qualifying Corporations

As displayed, being classified as a CCPC that is a qualifying corporation offers a much better return on your SR&ED claim. Keep in mind that it is possible to be a CCPC that is not considered to be a qualified corporation. A qualifying corporation is defined in the SR&ED Investment Tax Policy as:

- a corporation that is a CCPC in a particular tax year, with taxable income in the previous tax year that is not more than the corporation’s qualifying income limit (see section 4.2.1) for the particular tax year, or

- a corporation that is a CCPC in a particular tax year and is associated (see section 3.2) with one or more corporations, the total of the taxable incomes of the corporation and the associated corporations for their last tax year ending in the preceding calendar year that is not more than the corporation’s qualifying income limit for the particular tax year.11

So long as the CCPC’s taxable income is less than the qualifying income limit for that tax year, they will qualify for refundable ITCs. As per the CRA’s SR&ED Investment Tax Credit Policy, It is also important to note that:

Where a CCPC’s qualifying income limit is reduced to zero because the CCPC’s taxable capital is $50 million or greater in the immediately preceding year (see section 4.2.1), the CCPC is not a qualifying corporation and would not be entitled to any refundable ITC.12

The formula to determine a qualifying income limit can be found here. An ITC earned at the basic ITC rate by a CCPC, that is not a qualifying corporation or an excluded corporation, is not refundable. See the CRA’s Types of Corporations page for the full definition of a CCPC to determine whether your company is eligible for refundable SR&ED ITCs.

Provincial SR&ED Tax Credits

The credits discussed in this article pertain only to the definition of refundable and non-refundable ITCs, and how they are dispersed at the federal level within Canada. Some Canadian provinces offer their own SR&ED ITC programs that have varying degrees of refundability. See Provincial Tax Credits – Making the Most of SR&ED for details on provincial SR&ED programs across Canada, and whether they are refundable or non-refundable.

Conclusion

SR&ED Claimants understandably want to know how they will receive their SR&ED ITCs, and the difference between the two forms of SR&ED ITCs, refundable and non-refundable, can be confusing. The main difference becomes more clear once the Part 1 Tax is explained. Non-refundable SR&ED ITCs can only be utilized to offset the claimant’s Part 1 Tax for the taxation year. If the Part 1 Tax is reduced to nil and there are remaining non-refundable tax credits available, they may be carried back or forward to offset the Part 1 Tax in other tax years. See SR&ED Carry Back & Carry Forward at the Federal Level for more information on the SR&ED carry back and carry forward rules.

Only refundable ITCs may be paid out in cash format if so chosen by the claimant, and any SR&ED ITC that is refunded in the year reduces the ITCs available to carry forward or carry back. Claimants should be sure to confirm the status of their corporation to accurately estimate what their full SR&ED refund will be for the tax year. See Maximum SR&ED refund: Federal Level for a deeper understanding of how the maximize your refundable SR&ED tax credits.