Can you carry forward the Pool of Deductible SR&ED Expenditures?

Updated to Reflect New Policies (2022)*** Some of the policies referenced were updated 2021-08-13. This article has been updated and is accurate as of 2022. *** |

Scientific Research and Experimental Development (SR&ED) investment tax credits (ITCs) may be carried backed to be applied to the prior year’s taxes or carried forward to be applied to future year’s taxes. Additionally, the pool of deductible SR&ED expenditures may be carried forward to be used in future years. This post will explain carrying the pool of deductible SR&ED expenditures.

Pool of Deductible SR&ED Expenditures

In our post titled, SR&ED Carry Back & Carry Forward at the Federal Level, we discussed carrying forward ITCs at the federal level. In addition to ITCs, it is possible to carry forward the pool of deductible SR&ED expenditures. This can be beneficial when a corporation does not need to use the whole pool of expenditures in the current fiscal year. This is further explained in the Pool of Deductible SR&ED Expenditures Policy:

A positive balance in the pool of deductible SR&ED expenditures does not expire. It may be carried forward indefinitely and deducted in a subsequent tax year against any business income.

The CRA treats the pool of deductible SR&ED expenditures as a running balance; only the total balance carried forward is identified. The year to which each expenditure amount relates is not recorded or tracked. Since amounts in the pool can be carried forward indefinitely, it is not necessary to know the year to which an expenditure relates.

There are some restrictions on the carry forward of the pool after a loss restriction event (see section 8.0).1

The pool of deductible SR&ED expenditures carried forward is deducted against business income, not applied to future ITCs. The expenditures incurred in the taxation year count towards SR&ED ITCs.

Forms

T661

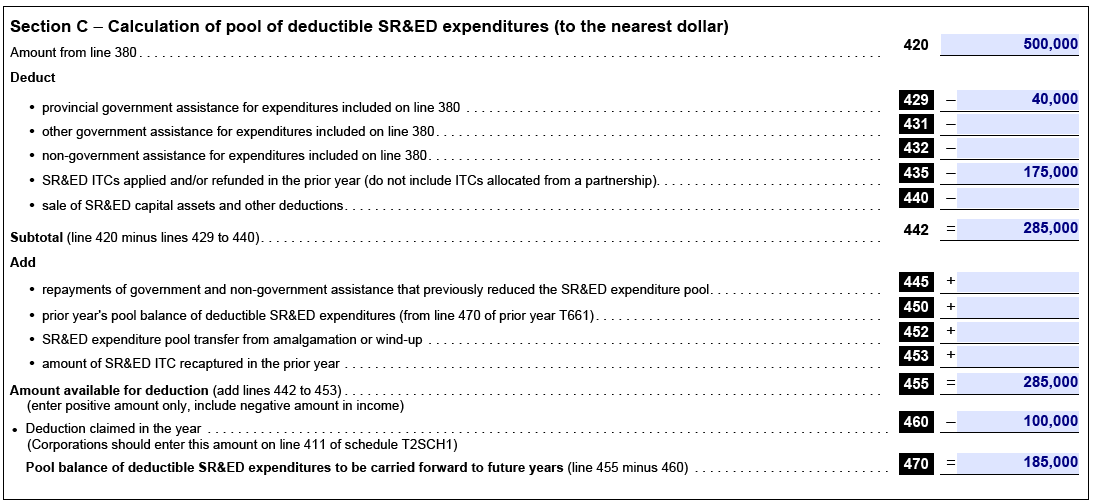

There is a section on the T661 where you must show the carry forward of the pool of deductible SR&ED expenditures.

- In the example, the corporation had $500,000 in current eligible SR&ED expenditures on Line 420.

- Provincial ITCs received are deducted on Line 429. SR&ED ITCs applied and/or refunded in the prior year are then deducted on Line 435.

- This provides a new total on Line 442.

- If there was carry forward from a prior year it would be recorded on Line 450.

- The total available for deduction is on Line 455.

- The amount claimed in the year is written on Line 460.

- The result is the pool balance of deductible SR&ED expenditures to be carried forward on Line 470.

- Next fiscal year, the amount on Line 470 will be recorded on Line 450.

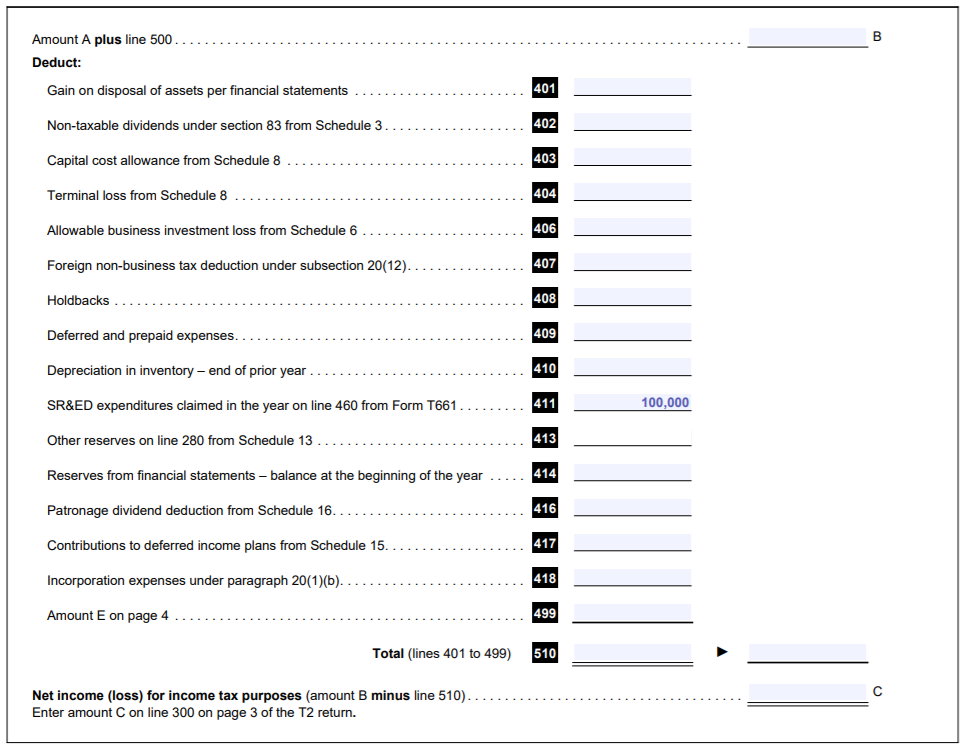

T2SCH1

The amount in Line 460 is also put in the T2SCH1 Line 400 to be deducted against the business income in the same taxation year.

In situations where there is an acquisition of control, the pool of deductible SR&ED expenditures is reduced to nil.2 This is something for corporations to be mindful of when acquiring a new organization that has a running balance of the pool of deductible SR&ED expenditures.

Conclusion

There are times when carrying forward the pool of deductible SR&ED expenditures makes the most sense and there are times when applying them during the taxation year earned is the most logical decision. Speak with your tax advisor or SR&ED consultant on what choice is best for your organization. Please reference our post on carrying forward and carrying back ITCs SR&ED Carry Back & Carry Forward at the Federal Level.