Business Project vs SR&ED Project: Not The Same

Once you understand the differences, you’ll see that comparing business projects and SR&ED projects is akin to comparing apples and oranges. One common source of confusion for first-time claimants is the difference between a business project and a Scientific Research and Experimental Development (SR&ED) project.

Given the critical importance of correctly separating activities/expenses between SR&ED work and routine commercial endeavors before filing a claim, we will discuss:

-

The characteristics of an SR&ED project; and,

-

Distinctions between a business project and an SR&ED project according to the Canada Revenue Agency (CRA).

Characteristics of an SR&ED Project

An SR&ED project is defined by the CRA as “a set of interrelated activities that together achieve or attempt scientific or technological advancement. All the activities within an SR&ED project must be related to the same advancement.”1

The Why and How of SR&ED

According to the Guidelines on the eligibility of work for scientific research and experimental development (SR&ED) tax incentives2, the SR&ED eligibility of a project is determined by the “Why” and “How” of the project.

The “Why”

The “Why” requires the presence of scientific or technological advancement. As “an SR&ED project starts when you identify the need for a scientific or technological advancement that overcomes an uncertainty”3 the work is ineligible if it is not completed for the purpose of scientific or technological advancement, regardless of the type of work being accomplished. The Guidelines state:

Work must be conducted for the advancement of scientific knowledge or for the purpose of achieving technological advancement (contained in paragraphs (a) to (c) of the definition). The key to both is the generation or discovery of knowledge that advances the understanding of science or technology. The type of knowledge in this context is conceptual knowledge, such as theories or prediction models, rather than just factual knowledge, such as data or measurements.4

For scientific or technological advancement to be present, there must first be a scientific or technological uncertainty. The CRA’s Guidelines on the eligibility of work for scientific research and experimental development (SR&ED) tax incentives explain how to determine if new scientific or experimental knowledge is required:

It is needed when it is unknown (or uncertain) whether a given result or objective can be achieved, due to an insufficiency in the available scientific or technological knowledge. This is referred to as a scientific or technological uncertainty. Note that the available knowledge is the combined scientific or technological knowledge of the resources within your business and those sources that are reasonably available to you publicly.5

The “How”

The “How” requires that the work must be systematic as contained in the definition of SR&ED and that while many businesses follow their own practices, and while these are often systematic it may not be enough. The Guidelines state:

It is important to distinguish between a systematic approach to carrying out work and the approach that is a systematic investigation or search called for in the definition of SR&ED. The latter approach includes:

- Generating an idea consistent with known facts, which serves as a starting point for further investigation toward achieving your objective or resolving your problem. Your idea may be expressed as a possible solution to a problem, a proposed method or an approach. This can be referred to as a hypothesis.

- Testing of the idea or hypothesis by means of experiment or analysis. The idea can evolve and change as a result of testing.

- Developing logical conclusions based on the results or findings of the experiment or analysis.

- Keeping evidence that is generated as the work progresses.6

SR&ED Project Exclusions

As noted in the Guidelines on the eligibility of work for scientific research and experimental development (SR&ED) tax incentives certain categories or work are considered ineligible for SR&ED. The categories include:

- Market research or sales promotion

- Quality control or routine testing of materials, devices, products or processes

- Research in the social sciences or the humanities

- Prospecting, exploring or drilling for, or producing, minerals, petroleum or natural gas

- The commercial production of a new or improved material, device or product, or the commercial use of a new or improved process

- Style changes

- Routine data collection7

These categories of work are referred to as exclusions and cannot be claimed. The guidelines state:

Excluded work should only be considered after you have identified that eligible work has been performed. This could mean that even if some of your work falls in the excluded categories, you may still have other work that is eligible. For example, your business may be conducting SR&ED while at the same time prospecting for minerals.8

Ensure the presence of eligible work before identifying the presence of ineligible work as it is possible for some portion of ineligible work to be claimed in support of the SR&ED project.

Not all of the work performed within a project will necessarily fall within the scope of an SR&ED project, but it is possible that even if some of your work falls in the excluded categories, you may still have other work that is eligible. The Guidelines on the eligibility of work for scientific research and experimental development (SR&ED) tax incentives state:

Any work that is commensurate with the needs and directly in support of basic research, applied research or experimental development work undertaken in Canada, falls within the meaning of SR&ED and can be claimed as part of the SR&ED project.9

While not all work is eligible for SR&ED, if it is commensurate with needs and directly in support of the SR&ED project then it may be classified as support work and the associated costs may be claimed.

Differentiating Between Business and SR&ED Projects

Defining how an SR&ED project differs from a business project remains essential in order to make certain your SR&ED claim is completed properly.

Since the purpose of an SR&ED project is “to advance scientific knowledge or to achieve a technological advancement”10 and it is required that there must be a scientific or technological uncertainty present in order for there to be a goal of scientific or technological advancement, it follows that a ‘business project’ is a project which has a commercial purpose and no scientific or technological uncertainty as defined with the Guidelines on the eligibility of work for scientific research and experimental development (SR&ED) tax incentives.

The CRA states that the purpose of a business project is:

“to achieve commercial success. The lifecycle of a business project may include many activities, often grouped into different projects, phases, and milestones.”11

A business project is one that is undertaken in order to produce some commercial benefit for the business at the conclusion of the project.

SR&ED Project Scenarios

The CRA made considerable changes to their SR&ED pages including the language and definitions surrounding business projects vs. SR&ED projects in July of 2023. The CRA has now outlined three distinct scenarios in which an SR&ED project may occur on their “Group work into SR&ED projects” page. A company’s projects are not always necessarily going to contain ALL business nor ALL SR&ED activities.

As we discussed above there are specific activities which are excluded from SR&ED and for which the related costs are not considered eligible expenditures for SR&ED. To claim SR&ED tax incentives, you need to separate your eligible work from this other work that is not eligible. After you have identified your eligible work, you can then group it into one or more SR&ED projects and depending on how your business projects are organized, there are different ways you can group your SR&ED work.

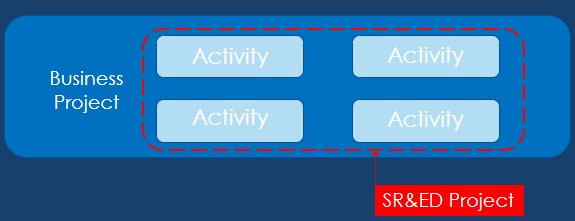

Scenario 1: All activities in your business project are eligible

Scenario 1 occurs when “all work in a given business project is eligible and can form one SR&ED project.”12 The image below is a visual example of a business project which contains four activities. These four activities are grouped together to form one SR&ED project:

In this case, all costs would be SR&ED eligible.

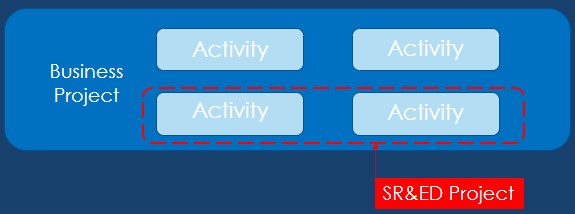

Scenario 2: Some activities within a business project are eligible

Scenario 2 occurs when a business project has a mix of eligible and ineligible work.13 Only the eligible work can be part of your SR&ED project. The image below is a visual example of a business project which contains four activities. Two of the four activities are grouped together to form one SR&ED project:

This is a common scenario that companies with commercial aspects or aims will encounter. The commercial aspects of the project are not eligible, and those related costs must be excluded for the purposes of claiming the SR&ED ITCs.

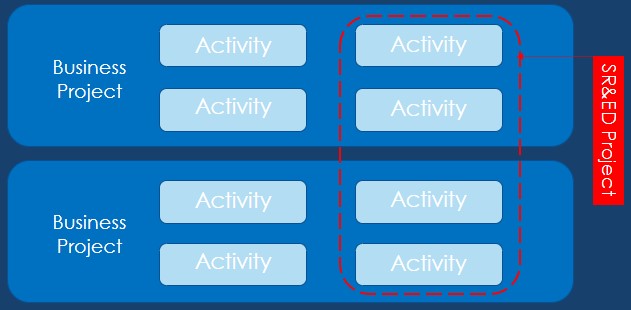

Scenario 3: Some activities over several business projects are eligible

Scenario 3 occurs when a business project has several business projects with a mix of eligible and ineligible work within them. The eligible work can be grouped “across your business projects into one SR&ED project as long as they relate to the same advancement.”14 The image below is a visual example of this scenario. It shows two business projects which both contain four activities. Two of the four activities from each business project are grouped together to form one SR&ED project:

This scenario is encountered by companies with commercial aspects or aims. The commercial aspects of the projects are not eligible, and those related costs must be excluded for the purposes of claiming the SR&ED ITCs. Keep in mind that the activities may only be grouped if they relate to the same advancement, otherwise, a separate SR&ED project must be formed.

Business vs. SR&ED Project: The Verdict

There is often confusion regarding the differences between SR&ED projects and business projects, especially during the process of separation and allocation of funds while filing a claim.

The CRA attempts to establish a clear understanding of what an SR&ED project involves.

SR&ED work bears very different objectives from the routine commercial endeavours of the business. While SR&ED attempts to achieve a technological or scientific advancement, a business project aims at enhancing an organization’s commercial and business standing. As per the characteristics of an SR&ED project, the key point is whether the work has the characteristics to meet the definition of SR&ED and not the overall goals in a commercial sense.

Thus, barring certain exceptions, the SR&ED project will usually be undertaken as a subset of a business project undertaken by the claimant organization.