SR&ED in the Federal Budget: A Minor Change With A Major Impact (2019)

Reference Article (>5 Years Old)

On March 19, 2019, the Liberal government Finance Minister, Bill Morneau, released the Federal Budget 2019. It proposed repealing the use of taxable income as a factor in determining a CCPC’s annual expenditure limit for the purpose of the enhanced SR&ED tax credit. As a result, small CCPCs with taxable capital of up to $10 million will benefit from unreduced access to the enhanced refundable SR&ED credit regardless of their taxable income.

SR&ED in the Federal Budget – Prior Budgets

The last major change to SR&ED occurred in the 2012 budget when sweeping modifications were made to several areas. The changes proposed by the government were phased into the system over several years as follows:

- January 1, 2013: Contract Payments reduced to 80% of the paid value.

- January 1, 2014: Proxy overhead calculations reduced to 55% from 65%.

- January 1, 2014: General SR&ED refundable credit reduced to 15% from 20%.

- 2014: All capital expenditures incurred during the 2014 fiscal period will not be eligible for SR&ED.

A minor change was made in 2017, which was covered in a brief bullet point under “Closing Tax Loopholes”:

Clarify the intended meaning of “factual control” under the Income Tax Act for the purpose of determining who has control of a corporation in order to prevent inappropriate access to supports such as the small business tax rate and the enhanced refundable 35-per-cent Scientific Research and Experimental Development Tax Credit for small businesses 1.

A Surprising – and Significant – Change in 2019

A significant announcement has been made in relation to SR&ED: repealing the use of taxable income as a factor in determining a CCPC’s annual expenditure limit for the purpose of the enhanced SR&ED tax credit. As a result, small CCPCs with taxable capital of up to $10 million will benefit from unreduced access to the enhanced refundable SR&ED credit regardless of their taxable income.

Scientific Research and Experimental Development Program

Under the Scientific Research and Experimental Development (SR&ED) tax incentive program, qualifying expenditures are fully deductible in the year they are incurred. In addition, these expenditures are eligible for an investment tax credit. The rate and level of refundability of the credit vary depending on the characteristics of the firm, including its legal status and its size 2.

- For all corporations other than Canadian-controlled private corporations (CCPCs) and for unincorporated businesses, a 15-per-cent non-refundable tax credit is available on all qualifying SR&ED expenditures.

- For CCPCs, a fully refundable enhanced tax credit at a rate of 35 per cent is available on up to $3 million of qualifying SR&ED expenditures annually. This expenditure limit for a taxation year is gradually phased out based on two factors, which apply on the basis of an associated group.

- The expenditure limit is reduced where taxable income for the previous taxation year is between $500,000 and $800,000.

- The expenditure limit is also reduced where taxable capital employed in Canada for the previous taxation year is between $10 million and $50 million.

- Qualifying expenditures in excess of a CCPC’s expenditure limit are eligible for the 15-per-cent tax credit. Unused SR&ED credits earned at this rate may be partially refundable depending on the CCPC’s taxable income and taxable capital.

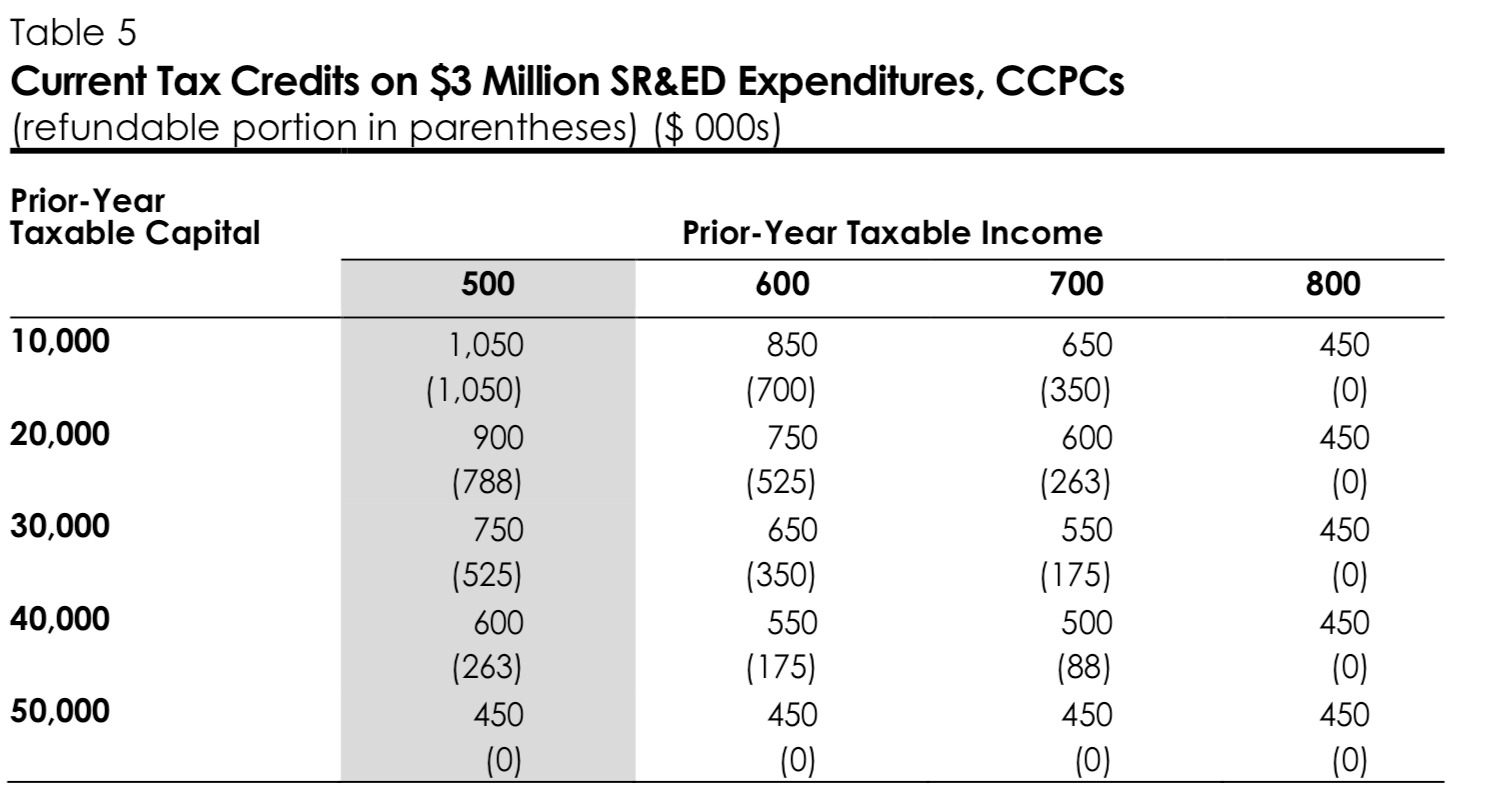

Table 5 presents the amount of SR&ED credits on $3 million of SR&ED expenditures at specific levels of taxable capital and taxable income under the current rules. In particular, it illustrates how these credits can be affected by a relatively small change in the amount of taxable income for firms within the phase-out range.

For example, a CCPC that spends $3 million on qualifying SR&ED expenditures in a taxation year, and that has $500,000 of taxable income and $10 million of taxable capital in the previous taxation year, is eligible for the 35-per-cent refundable SR&ED credit on all of its expenditures, resulting in a fully refundable credit of $1.05 million. If the corporation’s taxable income for the previous taxation year were $600,000 instead, the total SR&ED tax credits earned would have been $850,000 (of which $700,000 would have been refundable). For this CCPC, a $100,000 increase in taxable income would have resulted in a $200,000 reduction in SR&ED tax credits.

Budget 2019 proposes to repeal the use of taxable income as a factor in determining a CCPC’s annual expenditure limit for the purpose of the enhanced SR&ED tax credit. As a result, small CCPCs with taxable capital of up to $10 million will benefit from unreduced access to the enhanced refundable SR&ED credit regardless of their taxable income. As a CCPC’s taxable capital begins to exceed $10 million, this access will gradually be reduced as shown in the highlighted column in Table 5.

This change will provide a more predictable phase-out of the enhanced SR&ED credit rate, which will more effectively support growing small and medium-sized firms as they scale up.

This measure will apply to taxation years that end on or after Budget Day 3.

This change comes as a surprise – in the last decade, the changes have focused on reducing the amount disbursed via the SR&ED program. For more details, please review our summaries of previous federal budgets.

The government reasoning for the changes is as follows:

Improving Support for Small, Growing Companies

The Scientific Research and Experimental Development (SR&ED) Tax Incentive Program encourages business innovation by providing an investment tax credit for businesses of all sizes, in all sectors, that conduct scientific research and experimental development in Canada. In a global economy where knowledge and ideas are key, the innovation of Canadian firms will be a competitive advantage. The SR&ED Tax Incentive Program is often cited as a significant source of support by Canada’s innovative firms, as it provides a 35-per-cent refundable tax credit to eligible small and medium-sized businesses and a 15-per-cent tax credit to all businesses performing SR&ED in Canada. Access to the 35-per-cent rate is determined by a business’ level of income and capital.

One challenge often cited by entrepreneurs who use the SR&ED program to grow their firm relates to how the incentive changes based on the growth of their business.

To better support growing innovative businesses as they are scaling up, the Government proposes to eliminate the income threshold for accessing the enhanced credit. This will ensure continued enhanced support for small and medium-sized innovative businesses that are experiencing rapid growth in income or may have variable income from year to year; that is, at the exact time when continued Government support can help take a business to the next level. The capital threshold will continue to apply to ensure that the enhanced rate remains targeted toward small and medium-sized businesses. This change will build on other major initiatives put forward by the Government to help make Canada a leader in science and innovation, creating the jobs of tomorrow and building globally leading businesses 4.

What is the impact?

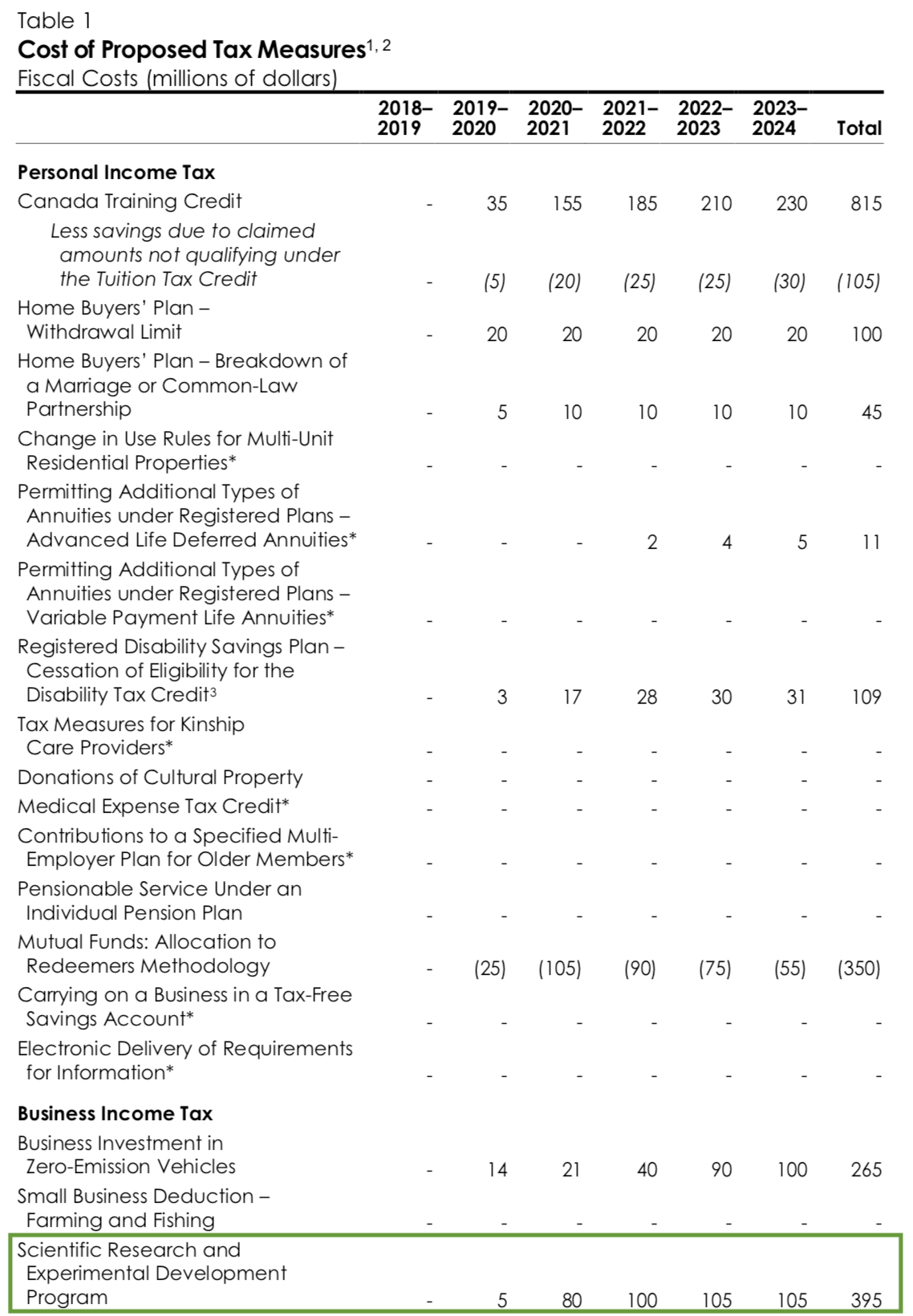

This is perhaps one of the most expensive proposed changes in the budget over the projected 5-year period. It is estimated that it will increase government spending by $395 million, which is only dwarfed by the Canada Training Tax Credit ($815 million).

What Does This Mean?

This will result in a sudden increase of SR&ED funding being provided at the federal level and a more predictable phase-out of the enhanced SR&ED credit rate, which will be of great benefit for some organizations; however, the changes do not address the systemic issues associated with submitting SR&ED applications and the complexity of the associated reviews, which can be both time-consuming and frustrating. Further, the increased tax incentive may mean more disputes that reach the Tax Court of Canada. Ultimately, while well intended, this change may put the program at risk of total elimination in future periods if the next government wants to cut costs.

The SR&ED program is one of many important tools in the innovation toolbox and must be wielded wisely. Thus, it now is up to the CRA to ensure that the interpretation of the policies and administration of the tax credit reflect the positive outlook of the budget, which seeks to support R&D in Canada.