Partial SR&ED Refunds on Commercial Capital Equipment?

Reference Article (>5 Years Old)

It is a reality of business today that very few companies can afford to purchase large, expensive pieces of equipment or machinery to ONLY perform SR&ED. It simply isn’t cost effective, as many companies would much prefer actually making salable products instead of simply learning about how to make them better. However, there is a way of claiming equipment used for both commercial activities and R&D work! Although capital expenditures are being removed from the SR&ED program in 2014, there is still time to claim these costs! Read on to find out more on partial SR&ED refunds.

SR&ED Capital Expenditure Primer

Capital costs are generally for large pieces of machinery, however, the SR&ED program also classifies software purchases as capital expenses.

There are two very common ineligible costs which come up often in the SR&ED tax office:

- Building Costs: It doesn’t matter that you built a brand new lab to house your new employees who spend every waking moment performing R&D on placentas and nanotubes. Buildings are not eligible for SR&ED. There is only a single building/structure which is classified as an R&D building in Canada. That’s it. Unless your building meets those kinds of standards, you can’t claim the costs for SR&ED.

- Used Equipment: Used equipment is completely ineligible for R&D tax credits. It doesn’t matter if it was originally used elsewhere in the world (i.e. Canada), was refurbished so it is essentially new (or so the vendor told you) or any other semi-plausible scenario. If it was used, it cannot be claimed for a SR&ED ITC. The reason for this is that someone will likely have used the equipment and claimed SR&ED for it already. On the plus side, used equipment can be included in the pool of eligible expenditures, and thus be deducted as an expense on your balance sheet.

With that in mind, the requirements to claim capital expenditures are extremely high. When you purchase a piece of capital, be it machinery, a device or software license, to obtain an SR&ED tax credit, the CRA requires that it be used All or Substantially All (ASA) for SR&ED activities. For the fiscal year being claimed >90% of its operational time during its operational lifetime must be used for SR&ED, or all of the value of the machine must be consumed while conducting SR&ED. These are outlined further in the Guide to the T661.

Why Shared-Use Equipment?

There are two primary advantages to claiming Shared-Use Equipment (SUE) as opposed to a traditional capital claim:

- Lower Usage Requirements: SR&ED capital costs require ASA. SUE only requires that the capital item be used >50% for SR&ED

- Lower Time Requirements: The CRA requires that a capital item used for SR&ED must be entirely used for SR&ED development for the entire expected lifetime of the equipment. For some machinery,this could be decades! And if you ever start using the equipment for commercial production, or sell the equipment, you incur an ITC recapture and have to pay back the tax credit you had originally claimed. SUE only requires that the equipment is used for SR&ED for the first 2-3 years, and doesn’t incur recapture payments.

The disadvantages of claiming SUE are:

- Higher Documentation Requirements: SUE requires records of actual use as opposed to intended use.

- Lower Refund: Only 50% of the cost can be claimed, and it is spread over two years.

Shared-Use Equipment for SR&ED – How To

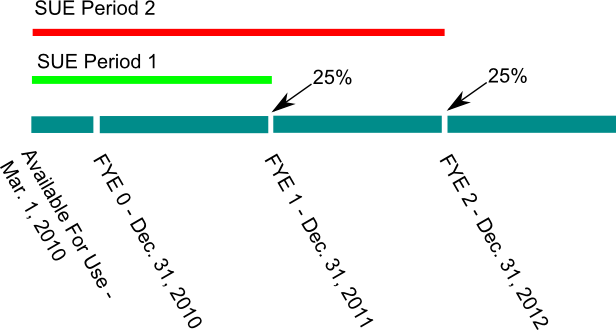

The Shared-Use Equipment approach can be used to claim equipment used for both commercial and research purposes. The general requirements of the program are tricky, but most importantly they can be used to claim equipment that was initially used for testing and development, before being re-purposed for commercial activities later on. The following diagram shows how the timeline for claiming SUE works:

The start of the timeline occurs as soon as the equipment is available for use, not when you pay for it. If a machine is boxed up in your warehouse because you are waiting for additional parts, it is not considered available for use. The first SUE Period is defined as the time between this available for use date and the end of the fiscal period ending at least 12 months from the start date. In the above example, SUE Period 1 is 22 months long, though it could vary between 12 months and 24 months depending on your company. For this period, the equipment must be used for SR&ED for >50% of its actual operational time. It doesn’t matter if the equipment was used entirely for R&D for the first 60% of the period, and entirely for commercial activities on the last 40%, as long as >50% on average is used for SR&ED investigations. Machine logs and other records are recommended for documenting this.

If these requirements are met, you are allowed to claim 25% of the original purchase cost of the equipment (including freight etc.) when preparing your SR&ED claim for FYE 2011.

The second SUE period is one year longer than the first, and overlaps the first period entirely. The same requirement of >50% SR&ED applies to this period as well. If the requirements are met, you are allowed to claim an additional 25% of the original purchase cost for the FYE 2012 SR&ED claim.

NOTE: The company must meet the requirements for BOTH PERIODS to successfully claim an ITC.

Conclusion

Capital expenses are difficult to claim for SR&ED given the high requirements of the program. However, these are often very expensive items, and even though you only receive a tax credit on 40% of the value, this additional cash can help offset the cost of other activities. The most important take-away from this article is that if you are considering a big-ticket item that will be used for R&D, document/record its use. Being able to show precisely how you meet the requirements of the SUE program will make the whole SR&ED claim process much smoother for all parties involved.