Proxy vs Traditional SR&ED Claim: Which Method to Choose?

Updated to Reflect New Policies (2022)*** Some of the policies referenced were updated 2021-08-13. This article has been updated and is accurate as of 2022. *** |

If you have never filed an SR&ED claim before you may not be aware that there are two methods available to you for filing your claim: proxy and traditional. This post contains a brief explanation of both the proxy and traditional methods. Each method has undergone several revisions in 2012, 2013, and 2014, please make sure you are referencing the most up-to-date information when filing your claim. While we cannot decide on the method for you, after reading this post you should be sufficiently informed to make the appropriate decision for your organization.

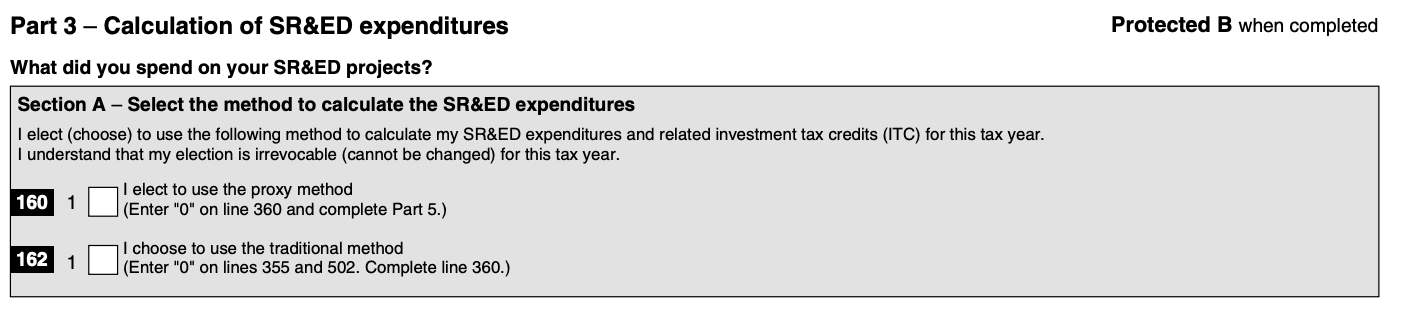

The traditional is the default method that will be selected for you if you do not choose the proxy method on Line 160 of the T661 form; however, this may not be the best option for your organization. It is important to review this decision carefully, as once the method has been selected, this will be the method used for all of your SR&ED projects for that tax year. You may change methods the following year, but once the claim process has been started you must complete that filing cycle with the method selected – even if it results in a lower refund.

Proxy Method

Most claimants with labour-intensive projects find the proxy method to be the easiest method of filling out an SR&ED claim. The equation used for SR&ED calculations is based on a notional Prescribed Proxy Amount (PPA) calculated as a percentage of the salary base. The salary base is composed of the salary/wages of employees directly engaged in SR&ED. It also includes specified employees but this amount may be limited. Since 2014, the PPA is 55% of the salary base – this means that if you have $100,000 in eligible salary expenditures, the CRA will “top up” your expenses by $55,000 (thereby giving you a pool of eligible expenditures of $155,000 instead of $100,000).

The Prescribed Proxy Amount Policy states:

- The PPA represents the amount of SR&ED overhead and other expenditures, and it is used only to determine the claimant’s qualified SR&ED expenditures for calculating the investment tax credit (ITC).

- A claimant does not include the PPA in the pool of deductible SR&ED expenditures and does not deduct it when calculating income for income tax purposes.

- The PPA is calculated (see section 3.0) as a percentage of the salary base (see sections 4.0 to 4.2).

- The actual overhead and other expenditures that the PPA represents are ordinary business expenses that may be deducted in the year.1

The PPA is intended to cover overhead and other expenditures such as general-purpose office equipment and furniture, office supplies, utilities, salaries or wages of staff providing service to SR&ED employees, travel, training, upkeep of premises, property tax and any other expenditure that would not otherwise have occurred had the SR&ED not taken place. It is important to ensure that your overhead costs exceed the proxy amount, otherwise, you will be subject to the PPA cap.

Materials consumed or transformed in the undertaking of SR&ED work in Canada are permitted and claimants can refer to the Materials for SR&ED Policy to confirm eligibility; however, these are not used when determining the proxy amount. Similarly, contract expenditures are also permitted but will not influence the proxy amount.

Traditional Method

As mentioned, this is the method that is automatically selected if you do not pre-select the proxy method. Please note that following the traditional method requires excellent record-keeping because claimants will be asked to identify and justify all SR&ED related overhead and other expenditures. With the traditional method, SR&ED expenditures such as general-purpose office equipment or furniture may be included – but it’s important to justify how these items relate to SR&ED.

The Traditional and Proxy Methods Policy states:

Under the traditional method, expenditures of a current nature on or in respect of SR&ED, include:

- An expenditure that is all or substantially all (ASA)attributable to the prosecution, or to the provision of premises, facilities or equipment for the prosecution of SR&ED in Canada;

- An expenditure that is directly attributable to the prosecution of SR&ED , or directly attributable to the provision of premises, facilities or equipment for the prosecution of SR&ED in Canada.2

In contrast to the proxy method, salary or wages incurred for clerical and administrative personnel who provide a service to SR&ED employees could be claimed as overhead, but this is decided on a case-by-case basis. For any non-R&D costs, you should be prepared to prove that the expenses are directly related to SR&ED by showing that had the SR&ED not occurred these expenses would not have been incurred.

The traditional method also allows for a retiring allowance as an overhead if it can be shown that this expense was solely attributable to the undertaking of SR&ED in Canada. Other allowable expenses under the traditional method relate to SR&ED employee moving expenses and taxable benefits related to the hiring of SR&ED personnel, as well as the cost of training SR&ED employees.

Note: If you use this method, it’s important to add your overhead costs to the T661 form. Many companies check the “Traditional” box on their first claim, forget to add in overhead expenditures (as they must be calculated manually), and lose out on thousands of dollars.

Example

In order to better illustrate the different calculations between the proxy vs. the traditional method, we have created a sample calculation below. We also suggest you try our online calculator as a predictive tool regarding your potential claim return.

Proxy vs. Traditional Calculation Method Example

ABC Corp is a CCPC with an ITC rate of 35% and the following SR&ED expenses over the past year:

- Employee Salaries $200,000

- Overhead $75,000

- Materials $20,000

| Claimable Expenses | Proxy Method | Traditional Method |

|---|---|---|

| SR&ED salaries | $200,000 | $200,000 |

| Materials | $20,000 | $20,000 |

| Overhead | $ (N/A) | $75,000 |

| TOTAL pool of deductible SR&ED expenditures | $220,000 | $295,000 |

| PPA Amount (55%) | $110,000 | $ nil |

| Total qualified SR&ED Expenditures | $330,000 | $295,000 |

| Total ITC earned (at 35% of qualified SR&ED expenditures) | $115,500 | $103,250 |

Comparison Table from the T4088

What are the benefits and challenges of each method? The CRA has outlined these in the T4088 – Guide to the T661.

| Method | Advantages | Disadvantages |

|---|---|---|

| Proxy method |

|

|

| Traditional method |

|

|

Conclusion: Choose the Best Method for your Company

Larger companies may find more benefit in the traditional method than smaller companies; however, the method selected should be based upon which will garner the largest SR&ED Investment Tax Credits. You should also weigh the strengths and weaknesses of your organization. Clearly, the traditional method of claiming SR&ED credits requires extensive, accurate record keeping. If this is not your forte then the proxy method may serve your organization better. Another factor to consider is the length of time it takes to file the claim using either method against the amount of the return. If the difference in return is negligible but the effort is extensive then you may want to go the less time-consuming route. Try our calculator to predict your return amount based on each method as a first step in the selection process.