Specified Employees in SR&ED: Restrictions and Regulations

Updated to Reflect New Policies (2022)*** Some of the policies referenced were updated 2021-08-13. This article has been updated and is accurate as of 2022. *** |

What is a “specified employee” in SR&ED, and how does the understanding of this term impact an SR&ED claim?

Small businesses account for just under 97.9 percent of all firms in Canada,1 and out of the 1,198,632 small businesses within Canada 1,163,027 (97%) belong to a corporation with fewer than 50 full-time employees.2 This suggests that in the small organizations claiming tax credits under the Scientific Research & Experimental Development (SR&ED) Program, specified employees are likely to be directly engaged in SR&ED work themselves.

In this post, we will discuss:

- The definition of a specified employee;

- The treatment of a specified employee under the Salary or Wages Policy;3 and;

- Any limitations placed on the expenditure claims of specified employees under the SR&ED program.

Definition of “Specified Employee”

A specified employee is an employee who does not deal at arm’s length with the employer or who is a specified shareholder of the employer. A specified shareholder is a person who owns, directly or indirectly, at any time during the year, 10% or more of the issued shares of any class of the capital stock of the employer or of any corporation related to the employer. A specified employee could also be someone related to a specified shareholder; e.g. a sister, a brother, a spouse, etc. For the purpose of determining the 10% threshold, shares owned by a person with whom the employee does not deal at arm’s length are included.4

Related SR&ED Employee Terms

Arm’s Length

Arm’s length refers to a situation where two parties that deal with each other are not related to each other and no control exists between them. It is a question of fact whether two parties not related to each other are dealing with each other at arm’s length.5

Related Individuals

According to paragraph 251 of the Income Tax Act, individuals connected by a blood relationship, marriage, common-law partnership or adoption are related persons. These relationships include parents (biological, legal or parents of a spouse), partners, children (biological, adopted or common-law), children’s partners (until the death of child or divorce), brothers and sisters (siblings or siblings-in-law), descendants (grandchildren, etc.), but do not include nieces, nephews, uncles, aunts or cousins.6

Directly Engaged

Even though this term is not included in the definition of specified employees, its consideration is important due to its effect on SR&ED expense claims under salaries or wages for specified employees. An expenditure on SR&ED work is made with respect to an expense for the salary or wages of an employee who is directly engaged in SR&ED in Canada. Therefore, SR&ED expense claims can only include the portion of an employee’s work that can reasonably and directly relate to SR&ED.

Whether an employee is directly engaged in SR&ED is based on the tasks that they perform and not on their job title. Directly engaged refers to “hands-on” work. Generally, employees (including managers and supervisors) conducting experimentation and analysis in the performance of basic research, applied research or experimental development (or when performing support work that is commensurate with the needs of the SR&ED project) are considered to be directly engaged in SR&ED.

Managers and supervisors who supervise the ongoing SR&ED work are also considered to be directly engaged in SR&ED when they are directing the course of the ongoing SR&ED work or when they are providing direct technical input into the SR&ED work. Non-technological management activities or decision-making functions that do not directly influence the course of the SR&ED, even if they relate to the SR&ED, are not considered direct engagement with SR&ED.7

Restrictions for Specified Employees

Salary Base for Prescribed Proxy Amount (PPA)

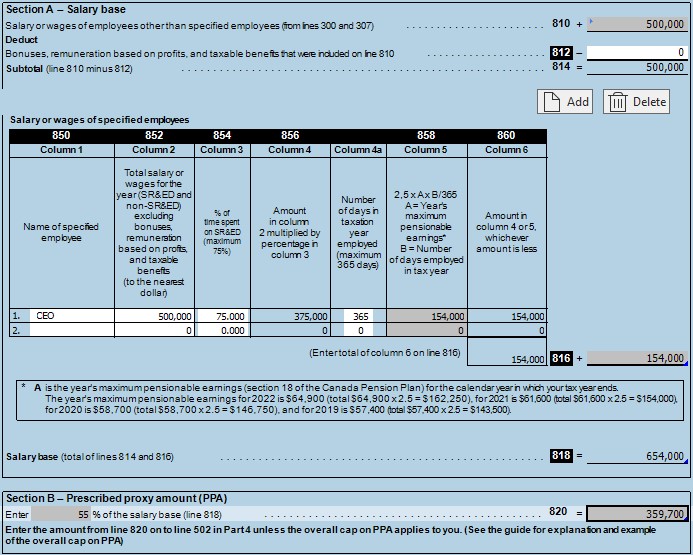

The Income Tax Regulations restrict the amount (“salary cap”) that a claimant can include in the salary base for a specified employee when using the PPA to the lesser of the following amounts:

-

75% of the specified employee’s total salary or wages, SR&ED and other (excluding bonuses, remuneration based on profits, taxable benefits, and prior years’ unpaid salary or wages paid in the last year); or

-

2.5 times the year’s maximum pensionable earnings (YMPE) for the calendar year in which the claimant’s tax year ends, prorated for the number of days of employment in the year.

The formula to determine the maximum amount that a claimant can include in the salary base for a specified employee for the year if using the PPA, in other words, for the second limit mentioned above, is:

2.5 × A × (B ÷ 365)

In this formula:

A is the YMPE for the calendar year in which the tax year ends.

B is the number of days in the tax year that the claimant employed the individual.8

The Canada Revenue Agency (CRA) sets the YMPE each year and within the SR&ED program, these amounts only apply to the specified employees in order to calculate the salary base. Non-specified employee salaries or wages are unaffected by these limits.9

For example, the CEO of a company, who owns 10% of the company, has a salary of $500,000 for the year 2021. The maximum amount of salary that can be claimed in the salary base is:

YMPE for 2020 is $61,600

$61,600 x 2.5 = $154,000

75% x $500,000 = $375,000

In this example, the maximum amount of salary that can be claimed in the salary base is $154,000 because it is the lesser of the two numbers.

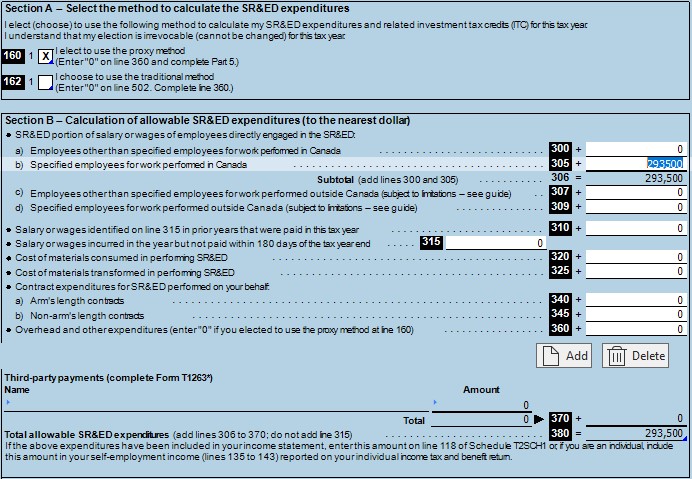

T661 Line 305

On the T661 Line 305 follows different rules for the maximum claimable amount for a specified employee, regardless of which method is chosen.

The amount that a claimant can claim as an expenditure on SR&ED for salary or wages of a specified employee is subject to a limit (salary cap). The salary or wages is limited to five times the Year’s Maximum Pensionable Earnings (YMPE) as determined under section 18 of the Canada Pension Plan and prorated for the number of days on which the claimant is a specified employee during the year.10

- 5 times the year’s maximum pensionable earnings (YMPE) for the calendar year in which the claimant’s tax year ends, prorated for the number of days of employment in the year.10

For example, the CEO of a company, who owns 10% of the company, has a salary of $500,000 for the year 2020. The maximum amount of salary that can be claimed on line 305 is:

YMPE for 2020 is $58,700

$58,700 x 5 = $293,500

In this example, the corporation may claim $293,500 on line 305.

Disallowance of Bonus from SR&ED Claim

As can be surmised from the information above, an SR&ED-related expenditure carried out in Canada does not include any bonuses or remuneration based on profits paid to a “specified employee.” If a corporation pays or accrues a bonus to an employee who is a specified employee, the bonus is not an expenditure in respect of SR&ED.12

The good news is that bonuses or remuneration based on profit for non-specified employees can be included in salary or wages for SR&ED.

Specified Employees Across Associated Corporations

No expenditures may be claimed for the salary or wages of a specified employee of two or more associated corporations unless the associated corporations file an agreement with the CRA using Form T1174 – Agreement Between Associated Corporations to Allocate Salary or Wages of Specified Employees For Scientific Research And Experimental Development (SR&ED).13

Related Corporations

Paragraph 251(2)(c) provides that two corporations will be related if:

The two corporations are controlled by the same person or group of persons.

Each of the corporations is controlled by one person, and the person who controls one corporation is related to the person who controls the other corporation.

One of the corporations is controlled by one person and that person is related to any member of a related group that controls the other corporation.

One of the corporations is controlled by one person and that person is related to each member of an unrelated group that controls the other corporation.

Any member of a related group that controls one of the corporations is related to each member of an unrelated group that controls the other corporation.

Each member of an unrelated group that controls one of the corporations is related to at least one member of an unrelated group that controls the other corporation.14

Specified Employees and SR&ED: Summary

Considering the smaller size of most SR&ED organizations, it is crucial to understand the treatment of specified employees under the various policies of the CRA.

A specified employee is an employee who does not deal at arm’s length with the employer or who is a specified shareholder of the employer. The Income Tax Act caps the claimable salary in the salary base for specified employees at the lesser between 75% of their total salary or wages (excluding bonuses, remunerations, etc.) or 2.5 times the yearly maximum pensionable earnings (YMPE) if using the prescribed proxy amount.15 The cap for the claimable salary of a specified employee on Line 305 is 5 times the YMPE.

If a specified employee is on the payroll of two or more associated corporations, neither corporation will be able to add this employee’s expenses to their claims until they fill and submit Form T1147,16 through which they will allocate the employee’s capped expenses across the various organizations.

This article is based on CRA policy documents and an income tax folio available at the date of publication. Please consult the CRA website for the most recent versions of these documents.

Comments are closed.