SR&ED and Agriculture: Hidden Tax Credits from Levy and Check-Off Fees

Updated: April 07, 2025

Hidden SR&ED Tax Credits from Levy and Check-Off Fees

How do I apply for SR&ED in Levy or Check-Off?

The Scientific Research and Experimental Development (SR&ED) tax credit is a federal government program administered by the Canada Revenue Agency (CRA) that encourages research and development by providing tax-based incentives for a wide range of industries including agriculture.

Conventionally, businesses may benefit from the SR&ED tax credits if they are engaged in R&D activities that advance knowledge regarding science and technology. However, if you are paying (non-refunded) service fees (i.e. levy or check-off) to an eligible third-party organization, you may be eligible for the SR&ED tax credit for the service fee payments.

How does it work?

The SR&ED tax credit can be earned on the annual portion of the producers’ service fees (levy or check-off) which were paid to an approved research entity for carrying out eligible R&D as determined by CRA.

The SR&ED tax credit is applicable to 80% of the annual portion of the producers’ service fees (levy or check-off) that were invested in eligible R&D at a CRA approved research facility. Farmers can calculate their total R&D contribution by referring to their sales receipts, which show the levy or check-off allocation. Fifteen percent of the applicable R&D expenditure is eligible to earn an SR&ED tax credit for individuals, rising to 35% for corporations that are considered Canadian controlled private corporations by CRA (see example calculations below).

How to File SR&ED in Levy or Check-Off

Investment tax credits may be claimed by filing form T2038(IND) for farm individuals or T2SCH31 for farm corporations. Growers who contribute to the check-off or levy and do not request a refund of the check-off or levy are eligible to receive SR&ED tax credits.

Follow the example below to file form T2038(IND) for farm individuals or T2SCH31 to apply for a federal refundable credit.

A grower contributed $10,000 in levy contributions and 20% of this was eligible for SR&ED tax credits.

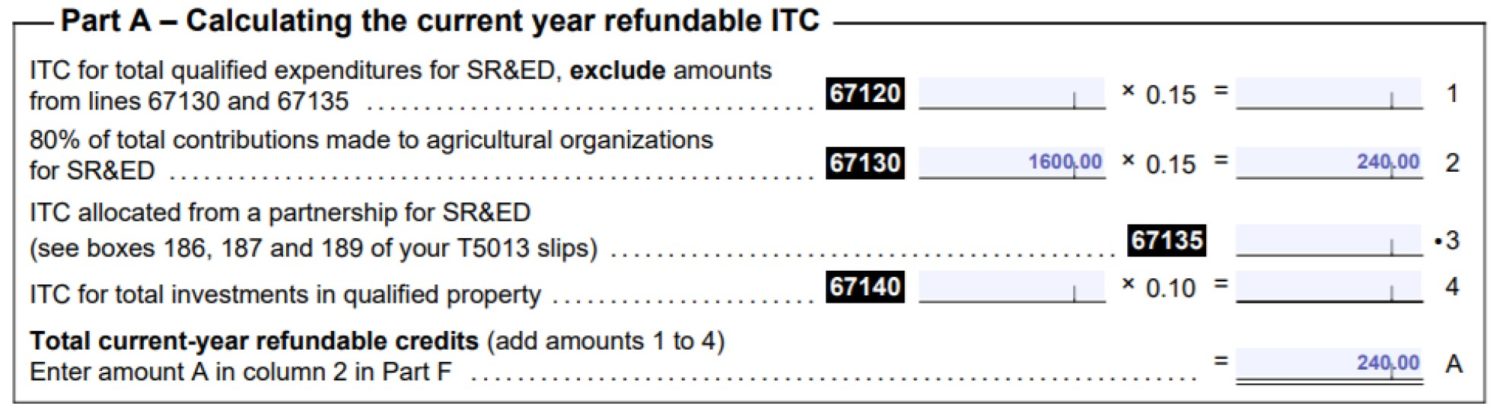

T2038(IND)

For our example:

Eligibility value: $10,000 x 20% = $2,000

Line 67130: $2,000 x 80% = $1,600

Once this number is put into line 67130 it is multiplied by 15% ($1,600 x 15% = $240)

Total federal refundable credit is $240.

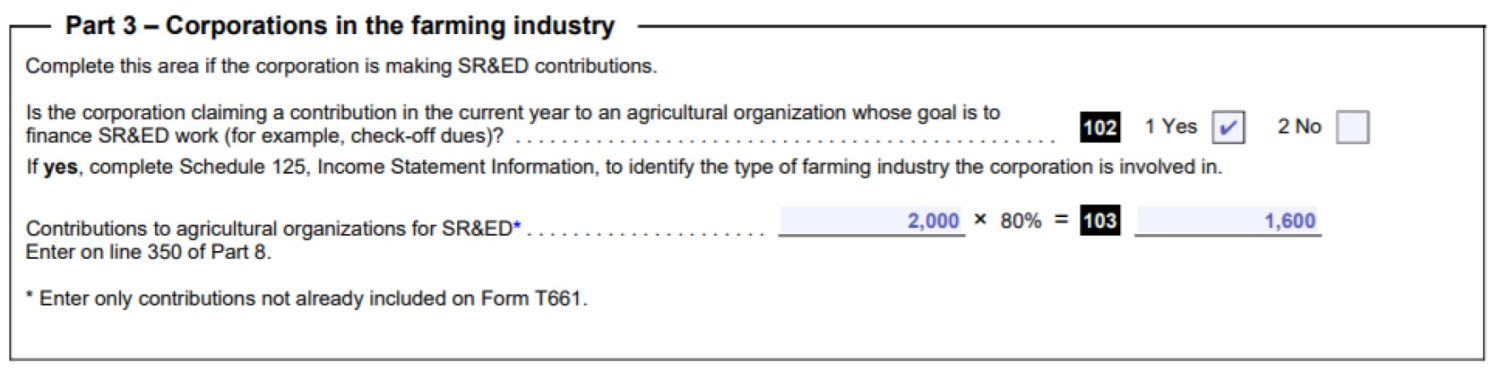

T2SCH31

For our example:

Eligibility value: $10,000 x 20% = $2,000

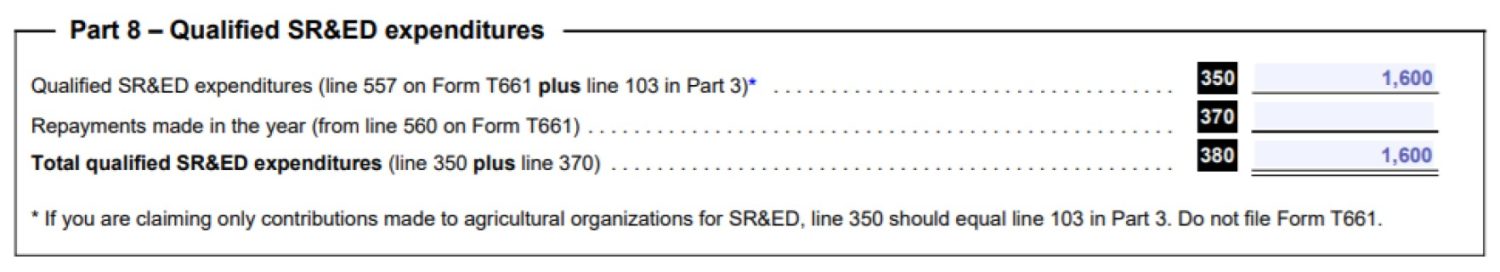

Line 103: $2,000 x 80% = $1,600

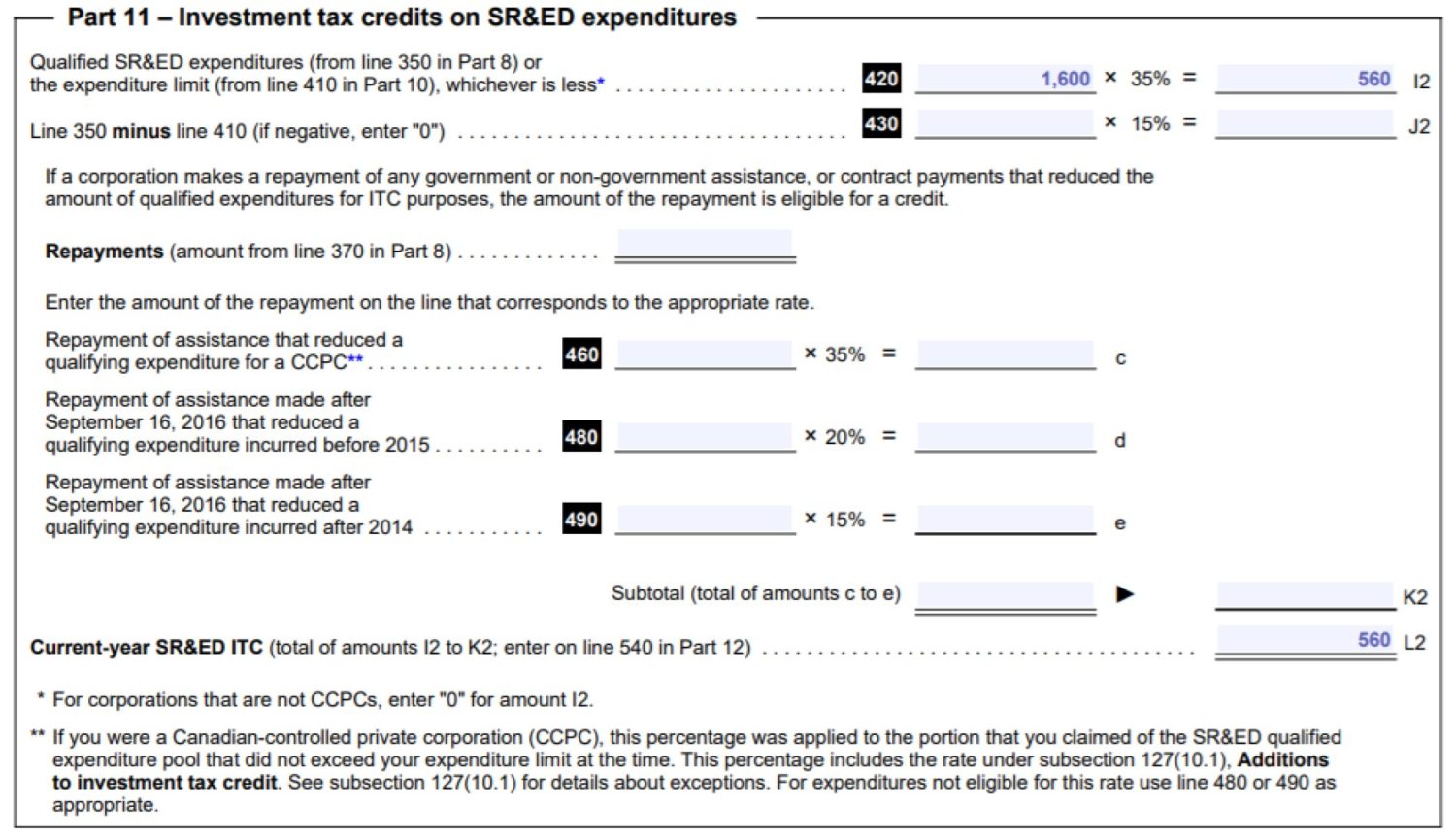

Once this number is put into line 103, it is automatically entered into Part 8 lines 350 and 380. Additionally, it is entered to Part 11 line 420 and multiplied by 35%. ($1,600 x 35% = $560)

With this example, the total federal refundable credit is $560.

Further information for specific provinces is provided below.

Alberta

Examples of R&D allocation in levy fees for Alberta over the past few years are shown below. Note that Alberta does not currently offer provincial SR&ED tax credits in addition to the federal program.

% SR&ED in Levy or Check-off Fees

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Fed | Fed | Fed | Fed | Fed | Fed | Fed | Fed | Fed | Fed | |

| Wheat | 20% | 20% | 21% | 17% | 31% | 31% | 32% | 74% | 34% | 32% |

| Barley | 17% | 21% | 17% | 7% | 13% | 7% | 12% | 11% | 34% | 32% |

| Canola | 11.88% | 9.77% | 14.32% | 17.43% | 23.69% | 21.3% | 14.59% | 20.93% | 12.49% | 14.56% |

| Oat | 16.5% | 17.9% | 11.8% | 14.3% | 10.9% | 8.4% | 8.9% | 13.9% | 7.8% | 10.42% |

| Pulse | 18.5% | 21% | 13.7% | 31.4% | 32.5% | 19.5% | 18.1% | 25.9% | 11.9% | 17.5% |

Any amounts without a link were generated from links that are no longer active; however, we have kept the information in this table to preserve it for historical purposes.

Organizations

Alberta Grains Commission (Wheat & Barley)

The mission of the Alberta Grains Commission (AGC) is:

“To increase the long-term economic sustainability of Alberta wheat farmers through innovative research, market development, policy advocacy, farm business management, agronomy and extension.” 1

The Commission recognizes check-off revenue at a rate of $1.09 and $1.20 per tonne for wheat and barley, respectively.2

[in 2023] Wheat and barley producers who pay check-off through Alberta Grains (formerly Alberta Barley and the Alberta Wheat Commission) and do not request a refund are eligible for a 34 per cent and eight per cent tax credit respectively through the Scientific Research and Experimental Development Fund (SR&ED) program for their investment in research and development (R&D) projects. For example, producers who paid $100 in check-off on their wheat in 2023 would earn $34 in tax credit, whereas producers who paid $100 in check-off on their barley in 2023 would earn $8 in tax credit. 3

Alberta Canola Producers Commission

The mission of Alberta Canola Producers Commission (ACPC) is:

“To support the long-term success of canola farmers in Alberta through research, extension, consumer engagement, and advocacy.”4

Canola farmers pay a refundable $1.00 per tonne service charge when they sell their canola to fund the ACPC.5

The Scientific Research and Experimental Development (SR&ED) tax credit enables canola growers to claim a credit for the portion of the service charge they paid that was utilized to support qualifying research. For the 2024 tax year, the tax credit rate for canola growers in Alberta is set at 14.56 percent. For example, an individual grower who paid $1,000.00 in service charge to Alberta Canola in 2024 would be eligible for a tax credit of $145.60.6

Alberta Oat Growers Commission – Part of the POGA

Alberta Oat Growers Commission (AOGC) was established in 2012 and is part of the Prairie Oat Growers Association (POGA).

The mission of the Prairie Oat Growers Association (POGA) is:

“Optimize oats as a competitive crop and increase grower profitability through the grower supported levy which directs and funds research, helps develop new markets and products for oats, influences policy, and builds partnerships with the oat industry around the world to better serve the Western Canadian oat grower.”7

Farmers who pay 50 cents per tonne levy on their oats are members of the AOGC.8

For 2023, Alberta producers may claim 7.8% of their levy contributions as a qualifying SR&ED expenditure on their federal tax return.9

Alberta Pulse Growers Commission

The mission of Alberta Pulse Growers Commission (APGC) is to:

“Lead through innovation and collaboration to add value for Alberta’s pulse farmers.”10

APG collects a refundable levy based on 0.75 per cent of the cash sale on pulse crops sold in the province.11

The SR&ED tax credit can be earned on the portion of the producers’ service fees which were paid to an approved research entity as determined by the Canada Revenue Agency. Each year a percentage of the Alberta Pulse Growers investment into research is calculated for the percent eligible for that tax year.12

Saskatchewan

In addition to federal SR&ED tax credits, Saskatchewan has additional tax credits available through the Saskatchewan Research and Development Tax Credit program. 13

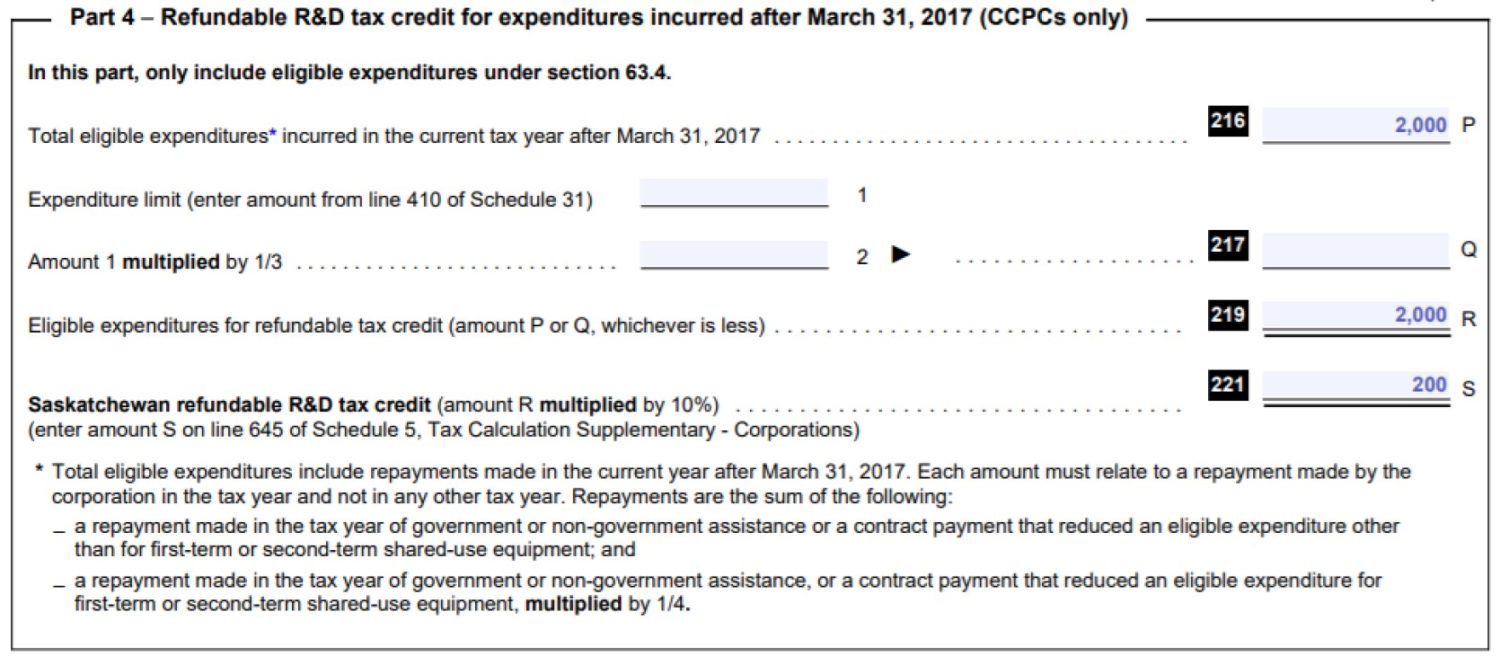

This provincial credit may be claimed by filing form T2SCH403.

Follow the example below to file form T2SCH403 to apply for a provincial refundable credit in Saskatchewan.

A grower contributed $10,000 in levy contributions and 20% of this was eligible for SR&ED tax credits.

For our example:

Eligibility value (Line 216): $10,000 x 20% = $2,000

Once this number is put into line 216, it will be entered into line 219. Then it is multiplied by 10% ($2,000x 10% = $200) and entered into line 221.

With this example, the total refundable credit from Saskatchewan is $200.

This is then added to the federal tax credit example from above.

$200 + $560 = $760 total refundable tax credits.

% SR&ED in Levy or Check-off Fees

Examples of R&D allocation in levy fees for Saskatchewan over the past few years are shown below.

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Fed/Prov | Fed/Prov | Fed/Prov | Fed / Prov | Fed / Prov | Fed / Prov | Fed / Prov | Fed / Prov | Fed / Prov | Fed / Prov | |

| Wheat | 3.34% / 2.36% | 19.07% / 17.55% | N/A | 21.25% / 18.11% | 28.92% / 20.74% | 38.33% / 23.95% | 67.93% / 48.97% | 79.85% / 55.27% | 81.03% / 53.52% | 86.76% / 56.40% |

| Barley | N/A | N/A | N/A | 7.97% / 17.64% | 15.9% / N/A | 22.7% / 12.7% | 45.9% / 23.1% | 72.2% / 42.7% | 30.8% / 17.7% | 58.9% |

| Canola | N/A | N/A | N/A | 32% / 26% | 36% / 23% | Not Released | 26.2% / 17.3% | 39.3% / 25.7% | 29% / 20.1% | 27.6% / 18.3% |

| Oat | 22.2% / 0% | 24.5% / 0% | 31.1% / 0% | 27.1% / 0% | 30.5% / N/A | 20.8% / N/A | 19.2% / N/A | 31.0% / N/A | 17.8% / N/A | 26.25% |

| Pulse | N/A | N/A | N/A | 40% / 45% | 40% / 45% | 12% / 11% | Not Released | 21% / 20% | 23% / 21% | 25% / 20% |

| Flax | N/A | N/A | N/A | 38.4% / 36.8% | 63.4% / 62% | 50.6% / 45% | Not Released | 58.6% / 54% | 25% / 15% | Not Released |

| Canaryseed | 26% / 0% | 43% / 0% | 38% / 0% | 17% / 0% | 53% / N/A | 38% / N/A | 45% / 40% | 60% / 52% | 42% / 42% | 31% / 31% |

| Mustard | 19% / 0% | 26% / 0% | 19% / 0% | 23% / 0% | Not Released | Not Released | Not Released | Not Released | Not Released | Not Released |

Any amounts without a link were generated from links that are no longer active; however, we have kept the information in this table to preserve it for historical purposes.

Organizations

Saskatchewan Wheat Development Commission

The mission of the Saskatchewan Wheat Development Commission (Sask Wheat):

“Sask Wheat will provide leadership in identifying and supporting research, market development, and advocacy to maximize profitable and sustainable wheat production for Saskatchewan farmers.”14

Check-off collection became mandatory on August 1, 2013. The check-off rate for wheat grown in the province is $1.00 per net tonne.15

For the crop year ending July 31, 2024, producers may claim 86.76% of their levy contributions as a qualifying SR&ED expenditure on their federal tax return.

In addition, farm corporations may claim 56.40% of their levy contributions as a qualifying expenditure towards the Saskatchewan Research and Development Tax Credit program. This credit may be claimed by filing form T2SCH403.16

Saskatchewan Barley Development Commission

The mission of the Saskatchewan Barley Development Commission (SaskBarley):

“To identify, develop and support research, market development, and extension initiatives that establish long-term, profitable and sustainable barley production for Saskatchewan producers.”17

Saskatchewan’s barley levy became mandatory August 1, 2013. The levy is $1.06 per net tonne.18

For the crop year ending July 31, 2023, producers may claim 58.9% of their levy contributions as a qualifying SR&ED expenditure on their federal tax return.19

Saskatchewan Canola Development Commission

The mission of the Saskatchewan Canola Development Commission (SaskCanola) is:

“To provide value to canola producers through research, advocacy, and market development.”20

A 75 cent ($0.75) per tonne levy on Saskatchewan produced canola is collected by buyers at the time of sale and then forwarded to SaskCanola.21 SaskCanola uses this levy to explore canola markets, research to benefit canola producers, and communication programs.22

For the 2024 crop/tax year, 27.6% of producers’ levy is eligible for the federal SR&ED tax credit (by means of cash refunds and/or reduction to taxes payable).

In addition, farm corporations may also claim 18.3% of their levy contributions as a qualifying expenditure towards the SR&D tax credit program for the 2024 crop/tax year.23

Saskatchewan Oat Development Commission – Part of the Prairie Oat Growers Association (POGA)

The mission of the Prairie Oat Growers Association (POGA) is:

“Optimize oats as a competitive crop and increase grower profitability through the grower supported levy which directs and funds research, helps develop new markets and products for oats, influences policy, and builds partnerships with the oat industry around the world to better serve the Western Canadian oat grower.”7

The Saskatchewan Oat Development Commission (SaskOats) was established by the provincial government in 2006 to begin collecting a 50 cents per tonne levy on all Saskatchewan-grown oats marketed commercially.25

For 2024, Saskatchewan producers may claim 26.25% of their levy contributions as a qualifying SR&ED expenditure on their federal tax return.26

Saskatchewan Pulse Growers

The mission of Saskatchewan Pulse Growers (SPG) is “to provide leadership and create opportunities for profitable growth for Saskatchewan pulses”.27

A 0.67% levy on the gross value of pulse crops sold is deducted at the point of sale by the buyer, assembler, or processor who purchases the crop from the farmer. This levy applies to all crops listed in SPG’s regulations, with the most commonly grown being peas, lentils, chickpeas, faba beans, dry beans, and soybeans grown in Saskatchewan and is remitted to SPG to fund research, market development, communications, market access, and more. The levy rate was lowered to 0.67% on August 1, 2016, down from 1.0% collected prior (2003–2016).28

For the 2023/24 crop year ending August 31, 2024, 25% of the Saskatchewan pulse levy qualifies for the federal SR&ED tax credit and 20% for the Saskatchewan Provincial SR&ED tax credit.29

Saskatchewan Flax Development Commission

The mission of the Saskatchewan Flax Development Commission (SaskFlask) is:

“To lead, promote, and enhance the production, value-added processing and utilization of Saskatchewan flax.”30

There is a mandatory flax check-off of $2.36 per tonne of seed and $0.50 per tonne of straw; this is refundable and supports research, communication, and market facilitation for Saskatchewan’s flax industry.31

For the crop year ending July 31, 2023 the federal SR&ED tax credit for levy-paying flax producers is 25.0%.

For the crop year ending July 31, 2023 the Saskatchewan Provincial SR&ED tax credit for levy-paying flax producers is 15.0%32

Canary Seed Development Commission of Saskatchewan

Canary Seed Development Commission of Saskatchewan (CSDCS) has a mandatory levy of $2.50 per tonne which is refundable.33

For the 2023-24 year ending July 31, 2024, Canary seed producers may claim 31 per cent of their checkoff contributions as a qualifying SR&ED expenditure on their federal tax return.

In addition, farm corporations may also claim 31 per cent of their levy contributions as a qualifying expenditure towards the Saskatchewan Research and Development Tax Credit program.34

Saskatchewan Mustard Development Commission

The mission of the Saskatchewan Mustard Development Commission (SaskMustard) is:

“to grow the mustard industry for the benefit of producers”35

There is a mandatory, but refundable levy of 0.5 per cent of the gross sales.36 The mustard levy allows SaskMustard to fund research, communications and market development programs; the goal is to improve yields, decrease input costs, increased demand and create an overall better product.37

For 2018, Saskatchewan mustard producers may claim 23% of their checkoff contributions as a qualifying SR&ED expenditure on their federal tax return.38

Manitoba

Manitoba does not currently offer additional SR&ED investment tax incentives in addition to the federal SR&ED investment tax credits.

% SR&ED in Levy or Check-off Fees

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Fed | Fed | Fed | Fed | Fed | Fed | Fed | Fed | Fed | Fed | |

| Wheat/Barley | N/A | N/A | N/A | 11% | 22% | 18.42% | 33.44% | 52.07% | 32.03% | 52.85% |

| Canola | 5.66% | 11.14% | 13.5% | 13.70% | 13.5% | 14.6% | 14.7% | 14.2% | 15.2% | 15.8% |

| Oat | 18.9% | 19.7% | 23.6% | 17.1% | 35.4% | 39.7% | 19.5% | 22.4% | 10.7% | 34.34% |

| Pulse | 37.57% | 32.46% | 48.42% | 40.05% | 73.68% | 34.67% | 23.82% | 26.37% | 19.2% | 14% |

| Flax | 44% | 48% | N/A | 32.61% | 12.81% | 33.44% | 33.44% | 52.07% | 32.03% | 52.85% |

| Corn | N/A | N/A | N/A | 25% | 25% | 8.43% | 33.44% | 52.07% | 32.03% | 52.85% |

| Sunflower | N/A | N/A | N/A | N/A | N/A | N/A | 34.44% | 52.07% | 32.03% | 52.85% |

Any amounts without a link were generated from links that are no longer active; however, we have kept the information in this table to preserve it for historical purposes.

Organizations

Manitoba Crop Alliance

In August 2020, Manitoba Wheat and Barley Growers Association (MWBGA), Manitoba Corn Growers Association (MCGA), Manitoba Winter Cereals, Inc. (WCMI), Manitoba Flax Growers Association (MFGA) and the National Sunflower Association of Canada (NSAC), combined to create the Manitoba Crop Alliance (MCA).39

The mission of the Manitoba Crop Alliance reads:

“For every levy dollar we collect, we maximize these resources into meaningful, independent research, valuable knowledge and targeted advocacy.”40

MCA received its designation regulation to collect a mandatory check-off from all sales of spring wheat, winter wheat, barley, corn, sunflower and flax in Manitoba starting on Aug. 1, 2020. The check-off amounts are unchanged from what was in place with the five previously existing organizations and the check-off remains refundable.41

| Crop Type | Check-Off Amount |

|---|---|

| Corn | ½ of 1% of sales |

| Flax | ½ of 1% of sales for flax and solin seed 1% of sales for flax and solin straw |

| Sunflower | ½ of 1% of sales |

| Spring Wheat | $1.00/tonne |

| Winter Wheat | $0.98/tonne |

| Barley | $1.06/tonne |

Manitoba Crop Alliance. About Manitoba Crop Alliance – Check-Off Information. Retrieved January 23, 2024. https://mbcropalliance.ca/about-manitoba-crop-alliance/check-off-information/]

For the 2023-2024 tax year, farmer members can calculate their total check-off contribution by referring to their wheat (spring and winter), barley, corn, flax and sunflower sale receipts. Of those totals, 52.85 per cent of the MCA check-off is eligible to earn an investment tax credit.42

Manitoba Canola Growers Association

The mission of the Manitoba Canola Growers Association (MCGA) is:

“Farmer funded, farmer focused. Driving success for Manitoba canola farmers through research, market development, advocacy and outreach.”43

The check-off rates is $1.00/tonne (2.2 cents/bushel).44

The rate for canola research in Manitoba in 2023 is currently pending approval from Canada Revenue Agency and has been requested at 15.2%.45

Manitoba Oat Growers Association – Part of the the POGA

The mission of the Prairie Oat Growers Association (POGA) is:

“Optimize oats as a competitive crop and increase grower profitability through the grower supported levy which directs and funds research, helps develop new markets and products for oats, influences policy, and builds partnerships with the oat industry around the world to better serve the Western Canadian oat grower.”46

In the Manitoba Oat Growers Association there is a mandatory levy of $.50 per tonne on all oats grown in Manitoba.47

For 2024, Manitoba producers may claim 34.34% of their levy contributions as a qualifying SR&ED expenditure on their federal tax return.48

Manitoba Pulse and Soybean Growers

The mission of Manitoba Pulse and Soybean Growers (MPSG) is:

“To provide research, production knowledge and market development support to Manitoba pulse and soybean farmers.”49

For the 2024 tax year, 14% of the Manitoba pulse check-off qualifies for the SR&ED tax credit.50

Conclusion

It is important to note that there are hidden SR&ED tax credits in agriculture. Paying a levy and/or check-off is essential for the farming industry as the third party organizations controlling those funds seek to advance the farming of each crop through SR&ED eligible projects. Not only are there tax benefits, but the associated technological and scientific advancements will help farmers in the future as well. Farmers should check with their specific province and organization to which they pay a levy or check-off to see what the current SR&ED tax credit is, as it varies each tax year.