SR&ED Study: The Canadian Bioproducts Industry Analysis of the Bioproduct Development Survey (2004)

Reference Article (>5 Years Old)

At SREDucation, we’re taking the time to document all of the changes that have occurred to the SR&ED program over the years. In our “From the Archives” series, you’ll be able to see how the program has evolved since its inception in 1986.

In 2004, “The Canadian Bioproducts Industry Analysis of the Bioproduct Development Survey” was published for the Canadian Agriculture Economics Association Meetings. The paper reported that access to capital was the major business barrier for small firms; however, less than half of survey respondents made use of the Scientific Research & Experimental Development (SR&ED) tax credit program.

Bioproducts Industry SR&ED Study Findings

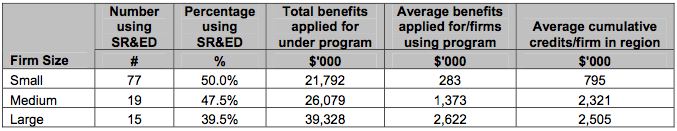

The paper presented “an analysis of the Canadian bioproducts sector based on the first survey of bioproduct firms in Canada.” Part of the study involved analyzing how companies in the industry gained capital; one such method discussed was through use of government support programs—including SR&ED. They found that “use of funding under the SR&ED tax program varied widely among the provinces and firm sizes,” discovering that firms in Quebec, Manitoba, and British Columbia had the highest percentage of companies applying for SR&ED. Additionally, small firms applied more often than large firms. “Small firms were more likely to use the SR&ED tax credit program,” they said, “but they applied for and received less than larger firms. Large-size firms have been the most successful in securing tax credits over the last five years.”

Firm use of SR&ED tax program in the past five years, by firm size, 2003 (Courtesy of The Canadian Bioproducts Industry Analysis of the Bioproduct Development Survey.)

Drawing SR&ED Conclusions

The authours concluded that the SR&ED program was a missed opportunity for companies in the sector to address their issues with capital. “The relatively limited use of the Scientific Research and Experimental Development, particularly in some provinces, represents an opportunity to improve the flow of capital to support research,” they said. Additionally, the authours recognized that SR&ED administrators needed to research why businesses didn’t apply in order to address the latent issues. “Just under half of firms used the SR&ED tax credit program and only one third accessed federal and provincial support programs,” they said. “Identifying the reasons why firms do not apply or are not successful can improve program use and value to the industry.” This article is based upon a report issued at the time: “The Canadian Bioproducts Industry Analysis of the Bioproduct Development Survey (2004)”.