Top 10 Things to Remember for your SR&ED Claim

Updated to Reflect New Policies (2022)*** Some of the policies referenced were updated 2021-08-13. This article has been updated and is accurate as of 2022. *** |

Who doesn’t love a good checklist? That feeling of accomplishment when you can cross items off one by one (even if one of the items on that list is “Have a cup of coffee”). What follows is a top 10 list of things you will want to do before filing your SR&ED claim. (Note: this list is for reference only and does not replace the advice of an SR&ED expert!)

Top 10 Things to Remember for your SR&ED Claim

- Did you prepare by attending CRA education seminars? This is not mandatory, but a little education goes a long way and you may learn something you would have otherwise missed. The CRA often hosts free SR&ED information sessions, and we have been known to host a session or two ourselves.

- Did you review the CRA policies on technical and financial eligibility? While these are extensive and can be overwhelming, the return on investment can be high if you take the time to understand the nuances of the policies. Generally speaking, before you undergo all the work of filling out forms and potentially being selected for a review, you should understand the basics. We have written several blog posts regarding eligibility, particularly as pertains to the five key questions. Check the CRA policies and guidelines, and be sure to touch base with a trusted SR&ED consultant if you are unsure.

- Do you have the right federal and provincial forms? The SR&ED investment tax credit program has been evolving in one form or another since the 1960s. Make sure you are using the most up-to-date SR&ED forms including the ones that are relevant to your province. You won’t want to miss out on any credits at either the federal or provincial level. We also have a handy interactive map that can help you determine the R&D tax credits in your province.

- Did you consult the Guide to the T661 (T4088) and the related provincial instructions? What is the T4088? It’s a guide to the T661 claim form itself. There are line-by-line instructions to assist you in correctly filling out your forms to ensure the smoothest and quickest possible processing time. This will also help guarantee you have provided enough of the correct information and that you have managed to avoid a common error – short, business-oriented descriptions.

- Did you complete all sections of the forms correctly? Did you fill out all the required sections? Great. Did you fill out all the sections of all the forms correctly? Clarity of your writing matters in the technical section (per the T4088), as much as ensuring you have the correct calculations in the financial sections. Pay attention to small things such as the title, which sets a good (or poor) first impression and if your costs are in line with the description.

- Did you use tax software? There are a variety of tax software options available. We’ve reviewed the most popular for you to help in your decision-making. The benefits of using tax preparation software include the ability to have your fields automatically calculated, you are less likely to make mistakes, you will be able to take advantage of all relevant deductions and you will save time.

- Did you have your forms (internally or externally) reviewed? An extra set of eyes is always a good idea. Someone at arm’s length will be able to provide an impartial assessment of your technical narrative (and maybe even pick up on a spelling mistake or typo) and double-check your financial calculations. Let’s be clear: the purpose of the SR&ED forms is to demonstrate your compliance with the policy requirements, not to impress anyone at the CRA with how intelligent you are. As such, the reviewer needs to be able to understand your project, how it complies with the policies, and whether the costs are reasonable. Writing in clear, plain, easily understood language is key.

- Did you complete one T661 Part 2 per project? Even if you are working on multiple projects during the taxation year, each one requires its own technical narrative. (If you have SO many you can submit the 20 largest projects by dollar value but the CRA reserves the right to request information on the remaining projects so there’s no excuse for not keeping the information handy!)

- Do you have your supporting documentation ready in case of review? A key component of SR&ED eligibility is contemporaneous documentation throughout the life of the project. In the event your claim is selected for a review you will need to have this documentation readily available to support your claim. Things like planning documents, details of experiments and trial runs, payroll records, lab notebooks, etc. are all good examples. We have listed some useful tools in a blog post as well.

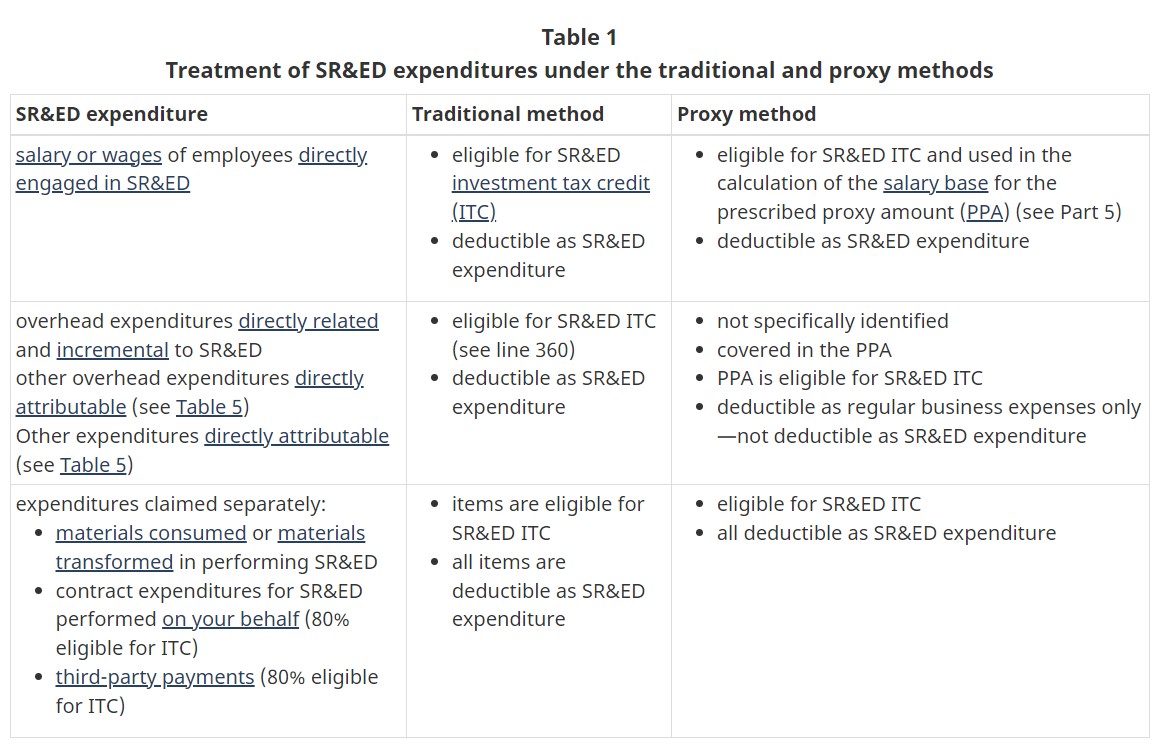

- Did you select the correct calculation of expenditures for your situation? Whether you use the traditional or the proxy method, you need to ensure your SR&ED expenditures are correctly calculated. Revenue Canada has a handy table to help you determine which method is best suited to your organization.

SR&ED – Challenging But Worthwhile

You may be feeling overwhelmed after reading the above SR&ED top 10 things to remember list, but keep in mind – applying for the SR&ED tax credit may be a worthwhile exercise if your refund is in the tens or hundreds of thousands. To help you estimate your refund, we have developed a handy SR&ED calculator. Don’t give up until you’ve checked this out – your hard work in preparing the claim will be worth it in the end – trust us!

Finally, did you have that coffee? In order to ensure the best possible outcome, you need to ensure you have all the best available resources. Just like some people can’t start their day without coffee, you shouldn’t think of filing a claim until you’re 100% confident you’ve put the best information forward. Filing an SR&ED claim can be time-consuming but it is definitely worth it.