Staying Afloat: How to Navigate the Changes to SR&ED (2013)

Reference Article (>5 Years Old)Please note that the information herein may be outdated, links could be inactive, and policies discussed may have evolved. For the most current data, consult our latest publications. If you would like us to refresh this article as it is of interest to you, please contact us. |

Having trouble navigating changes to the Scientific Research & Experimental Development (SR&ED) tax incentive program? Even if you understand how the updates affect you, it can be difficult to discern what to do about them. Here are some suggestions to ensure you’re staying ahead of the curve and receiving the refund you deserve.

Between the financial changes announced in the 2012 budget, the results of the policy review project, the adjustments from the 2013 budget, and the new T661 form, the SR&ED program has been undergoing an overhaul the likes of which hasn’t been seen for years. How do you react to a system that feels like it’s constantly in flux?

As difficult as it may seem, there are actions you can take to ensure your refund doesn’t get left behind in the dust. Here are some suggestions you can implement immediately to save yourself thousands—as well as headaches—down the road.

Verifiable Self-Compliance: Prove It!

The CRA’s internal mandate is to look for verifiable self-compliance: proof that a company understands the rules of SR&ED and is diligently working to stay within them. Documentation is the most important aspect of compliance with CRA stipulations.

While it can be confusing trying to understand exactly what you should be documenting, the T661 form actually lists all the types of documentation you’re able to leverage to substantiate your claim. These include:

- Project planning documents;

- Project records and laboratory notebooks;

- Records of trial runs;

- Photographs and videos; and

- Many more.

The key to making sure your company tracks everything it should is setting up internal processes that allow you to record documentation in real time. Rather than scrambling to pull everything together at the end of the development cycle, having systems in place to obtain CRA-approved documentation while actually performing SR&ED work streamlines the application process.

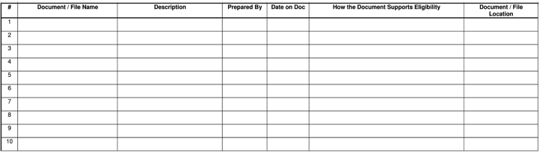

A sample chart for recording SR&ED documentation.

Claim ALL Eligible SR&ED Expenditures

Most businesses don’t receive the largest SR&ED refund they could because they don’t claim all the expenditures available to them. Specifically, support work—defined by the CRA as work that is “directly in support of and commensurate with the needs” of SR&ED—is often missed when calculating eligible costs.

A basic test to know if your support work is eligible is to ask yourself if the original project could have succeeded without that particular task occurring. Types of eligible support work include engineering, design, and operations research—but only when commensurate with the needs of SR&ED.

Additionally, with the removal of capital expenditures as an eligible cost as of January 1, 2014, it’s important to note that in order to claim it, capital equipment must be in use by December 31, 2013. Ignoring this key distinction could cost companies thousands.

Use Available Resources: Get Help!

It’s nearly impossible to adjust to all of these changes without some outside help. Luckily, companies have many available places to seek assistance.

- CRA Resources: The CRA offers many different programs to assist claimants, including the Pre-Claim Project Review (PCPR) service and the Account Executive (AE) service. Additionally, their website contains a huge amount of information (e.g., a complete SR&ED glossary).

- Independent Texts: Books and websites exist specifically to help companies who require help applying for SR&ED.

- SR&ED Courses: Some companies offer educational courses to assist business looking to gain more knowledge about the SR&ED process. Contact SREDucation if you’re interested in learning about the lessons we offer.

- Consultants: If you’re looking for a more hands-off approach to the program, consultants can offer advice or help with claim preparation.

With all the changes occurring to the program, the most important thing to remember is to be proactive. Whether it’s verifiable self-compliance, researching eligible SR&ED expenditures, or seeking help from outside parties, taking the time to stay on top of the new regulations will ensure you receive the refund you deserve.