Providing Third-Party Claim Preparer Information on Your T661 Form

Updated to Reflect New Policies (2022)

*** Some of the policies referenced were updated 2021-08-13. This article has been updated and is accurate as of 2022. ***

Things to look out for when completing the T661 form for SR&ED: If you have used a third-party claim preparer to help file your SR&ED claim, ensure you provide all the information that is requested.

There is substantial paperwork to prepare when filing your taxes, including the forms required to claim SR&ED. When preparing to claim SR&ED, you may rely on a third-party claim preparer to assist you with completing the required forms. However, if you choose to have a third-party complete the T661 Scientific Research and Experimental Development (SR&ED) Expenditures Claim form,1 you must provide information about that claim preparer. If you do not, you and the claim preparer could be charged up to $1,000 in penalty fees.2

This article reviews the Income Tax Act and the context behind why you must provide this information, and will highlight the location on the T661 form that you can complete this information.

The 2013 Federal Budget and Third-Party Claim Preparers

The 2013 Federal Budget amended the Income Tax Act (ITA) in section 162, subsection (5) to read:

Every person or partnership who makes, or participates in, assents to or acquiesces in the making of, a false statement or omission in respect of claim preparer information required to be included in an SR&ED form is jointly and severally, or solidarily [sic], liable, together with any claim preparer of the form, to a penalty equal to $1,000.3

The Income Tax Act and Third-Party Claim Preparers

The ITA, however, also now states that if the claim preparer exercised due diligence in preparing the claim, they are not liable to pay the penalty:

A claim preparer of an SR&ED form is not liable for a penalty under subsection (5.1) in respect of a false statement or omission if the claim preparer has exercised the degree of care, diligence and skill to prevent the making of the false statement or omission that a reasonably prudent person would have exercised in comparable circumstances.4

According to the definitions in the ITA, a “claim preparer” is “a person or partnership who agrees to accept consideration to prepare, or assist in the preparation of, the form but does not include an employee who prepares, or assists in the preparation of, the form in the course of performing their duties of employment.” 5

When the ITA refers to “claim preparer information” it means “prescribed information” regarding:

(a) the identity of the claim preparer, if any, of an SR&ED form; and,

(b) the arrangement under which the claim preparer agrees to accept consideration in respect of the preparation of the form.6

The SR&ED Glossary defines “prescribed information” as “the information to be provided on a form, or the manner of filing a form, as authorized by the Minister of National Revenue.” 7

Why are Third-Party Claim Preparers Potentially Liable to Pay the Penalty Fee?

The obligation to provide third-party claim preparer information was introduced in the 2013 Federal Budget. The Canada Revenue Agency (CRA) stated that this was introduced in order to provide:

[…] more detailed information on SR&ED program claim preparers and billing arrangements. In particular, in instances where one or more third parties have assisted with the preparation of a claim, the business number of each third party is now required, along with details about the billing arrangements including whether contingency fees were used and the amount of the fees payable. In instances where no third party was involved, the claimant is now required to certify that no third party assisted in any aspect of the preparation of the SR&ED program claims.8

It can be argued that the CRA introduced the requirement to determine if there was a correlation between using third-party claim preparers and reported instances of non-compliance in the SR&ED program.

The Media and Lobby Groups’ Influence on Government Policy

Although unsubstantiated, media outlets reported between 2011 and 2012 that claim preparers were consistently charging high contingency fees on successful SR&ED claims, thus taking large portions of the SR&ED tax credit from firms and “[moving the money] out of the science, research and development sector and […] into another area of [the Canadian] economy.” 9 The Globe and Mail also reported in 2011 that a third or more of tax credits paid out on SR&ED claims were “being wasted and paid to consultants as a result of hazy rules on what’s legitimate R&D.” 10

These commentaries on contingency fees came after the February 2011 Jenkins Report, which suggested that “more detailed information could […] be submitted by taxpayers on their costs of compliance, including in particular the use of contingency fee arrangements and consulting costs.” 11

The report suggested that smaller companies were hiring third-party consultants with high contingency fees to help them file their SR&ED claim due to the program’s complexity, stating “many smaller businesses find the claims process so unwieldy that they are forced to engage SR&ED “consultants,” sometimes surrendering significant percentages of their refunds as contingency fees.” 12 It can be argued that the report’s authors introduced this recommendation in order to measure the success of their other recommendations to simplify the SR&ED program. As an example; if the number of claimants that utilized third-party claim preparers decreased, it could indicate that the other measures introduced to simplify the program were also successful.

Third-Party Claim Preparer Information in the T661

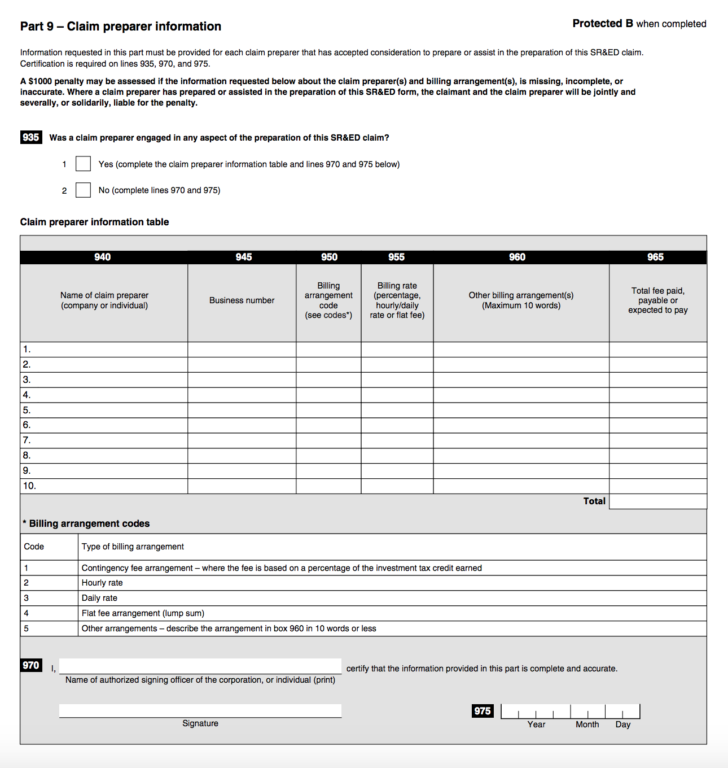

Part nine of the T661 form asks for all the information that needs to be submitted regarding any third-party claim preparers that assisted you with the completion of your SR&ED claim.13

Line 935: “Was a claim preparer engaged in any aspect of the preparation of this SR&ED claim?” Asks you to check one of two boxes, Yes or No.

If the answer is “Yes,” then you will need to fill out lines 940 to 975, which ask for the following information:

- the name of your claim preparer(s);

- their business number(s);

- the billing arrangement (ie. contingency fee, hourly rate, et cetera);

- the billing rate;

- other billing arrangements; and,

- total fee paid, payable or expected to pay.

The form then requires you to sign and date this information, prior to the official signature section of the form, which is Part 10 – Certification.13

Summary

In 2011 the Jenkins Report recommended the government introduce measures to quantify how often third-party claim preparers were used, and in 2011 and 2012 the media published unsubstantiated claims of high contingency fees and their effects on the SR&ED program. The report and pressure from the media led to the introduction of a dedicated section for third-party claim preparer information in the T661 form, Part 9 – Claim preparer information.13

Despite concerns that this is an invasion of privacy which forces unfair disclosure of business information to large accounting firms, this is considered “prescribed information” and the form must be completed.16 This is to ensure that those claiming SR&ED are compliant with the program’s eligibility requirements. Therefore, do not forget to include information about your claim preparer where asked, otherwise both you and your third-party claim preparer may be faced with high penalties.